September 2nd, 2021 at 5:31 pm

Image of the Day: Targeting Florida Gov. DeSantis Doesn’t Make Sense

It’s unsurprising that leftists and the Biden Administration desperately seek to shift the topic from their disastrous Afghanistan withdrawal, which has Biden’s approval/disapproval underwater and sinking further. But targeting Florida Governor Ron DeSantis and Texas Governor Greg Abbott seems strange, especially when one of the worst examples of Covid mismanagement remains their erstwhile hero and Emmy recipient Andrew Cuomo:

January 4th, 2021 at 9:51 am

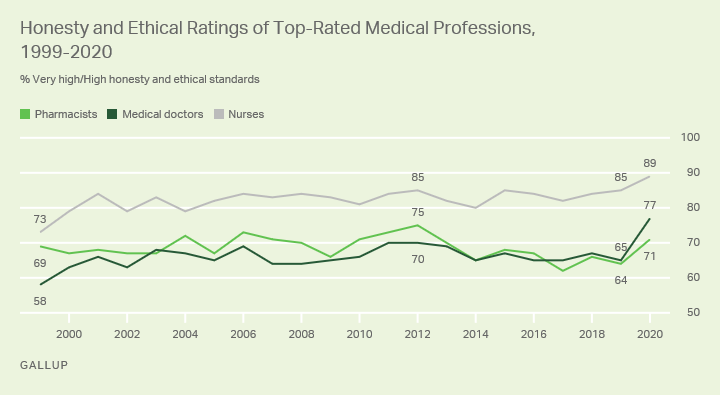

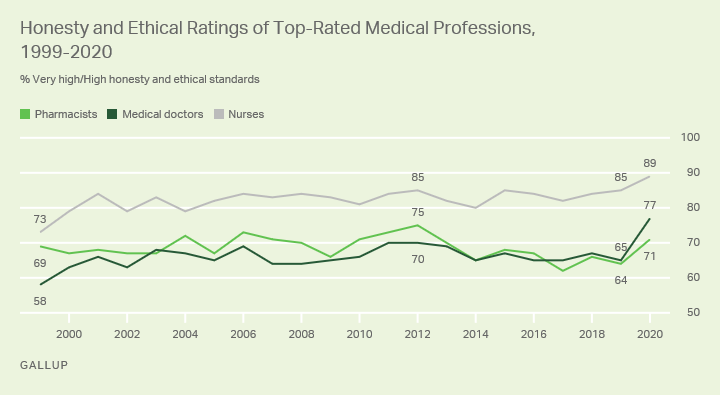

Image of the Day: Medical / Pharmaceutical / Healthcare Sector Approval Skyrockets

Although the year 2020 was a trying one in so many ways, one bright spot that we at CFIF repeatedly highlighted is the wondrous way in which America’s pharmaceutical sector came to the rescue, achieving in one year what typically takes a decade or more: devising and perfecting not one, but multiple lifesaving vaccines. It’s therefore no surprise, but welcome nonetheless, that Americans’ approval of our healthcare sector and its workers skyrocketed. Their remarkable achievements have not gone unnoticed:

Medical Sector Approval Skyrocketed

November 12th, 2020 at 11:49 am

Images of the Day: Unemployment Claims Plummeted Faster After $600 Checks Expired

As the nation debates continuing coronavirus stimulus, AEI offers an eye-opening analysis: Unemployment claims plummeted and the employment picture improved much faster after those $600 checks expired, reestablishing that while we always want to help those who cannot help themselves, government payouts can sometimes reduce incentives and ability to return to the workforce. And this doesn’t even reflect remarkably positive employment reports released by the government since the end dates:

Continuing Unemployment Claims Dropped

Initial Unemployment Claims Dropped

October 2nd, 2020 at 11:40 am

A Note from CFIF on President Trump’s Positive Coronavirus Test

Amid an excessively acrimonious partisan landscape, we simply wish to extend the CFIF family’s best wishes of luck and health to President Trump following his positive test for coronavirus, as we wish to anyone and everyone who has tested positive, as well as those loved ones affected by it. In similar spirit, we express gratitude that Joe Biden and his wife have reportedly tested negative.

August 18th, 2020 at 1:09 pm

Image of the Day: Gov. Cuomo’s Conspicuous Malpractice

New York Governor Andrew Cuomo made for a curious choice by Democrats to appear in a feature role on the first evening of their “convention”:

NY Gov. Cuomo’s Incompetence

June 23rd, 2020 at 9:33 pm

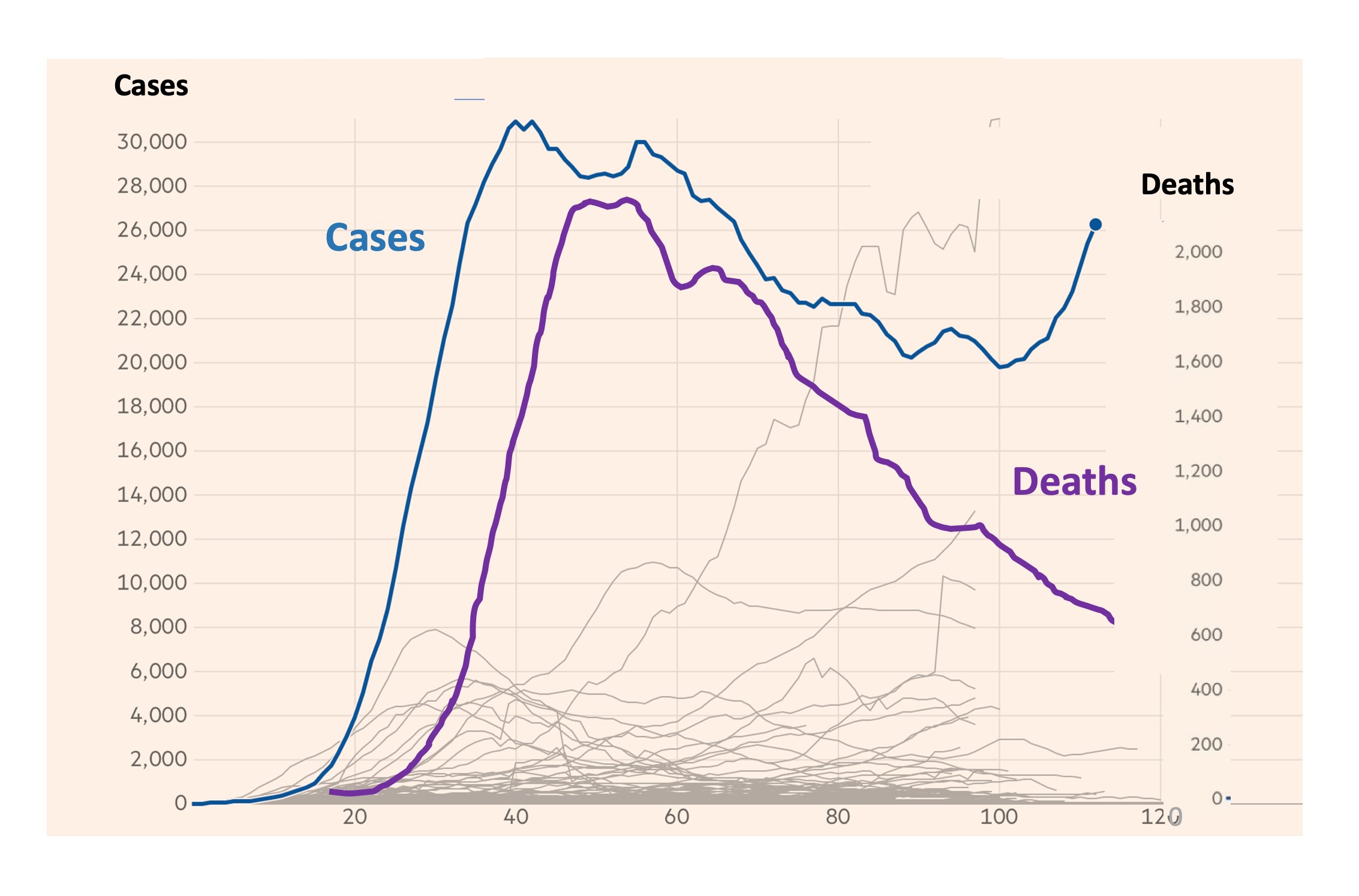

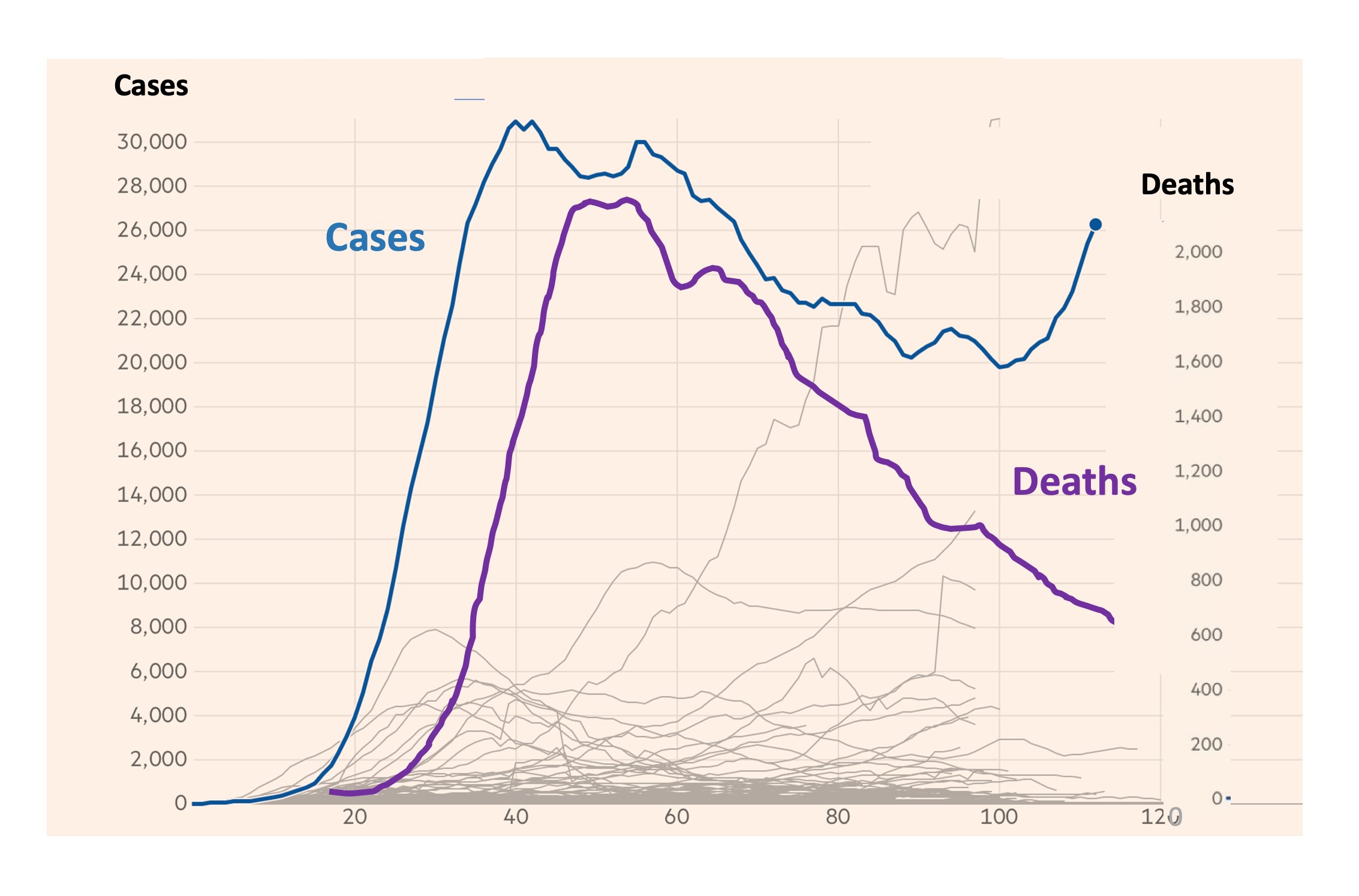

Image of the Day: Coronavirus Rolling Average Deaths Plummet

Perhaps this helpful rolling average graph from Eric Topol explains the curious shifting media focus to cases instead of actual deaths while the economy continues to reopen and improve. Not that we’re cynical.

Coronavirus Deaths Plummeting

June 5th, 2020 at 9:46 am

Trump Bump: Record New Jobs Added in May, Unemployment Unexpectedly Plummets

Defying nearly universal economists’ expectations, it was just announced that the American economy added a record 2.5 million jobs last month, and the unemployment rate actually fell sharply to 13.3%. Surveyed economists had anticipated a loss of 8.3 million jobs, and a rise in unemployment to 19.5%. The Dow instantly shot up nearly 1,000 upon opening, and we’re nearly back to its pre-coronavirus record levels.

June 1st, 2020 at 10:23 am

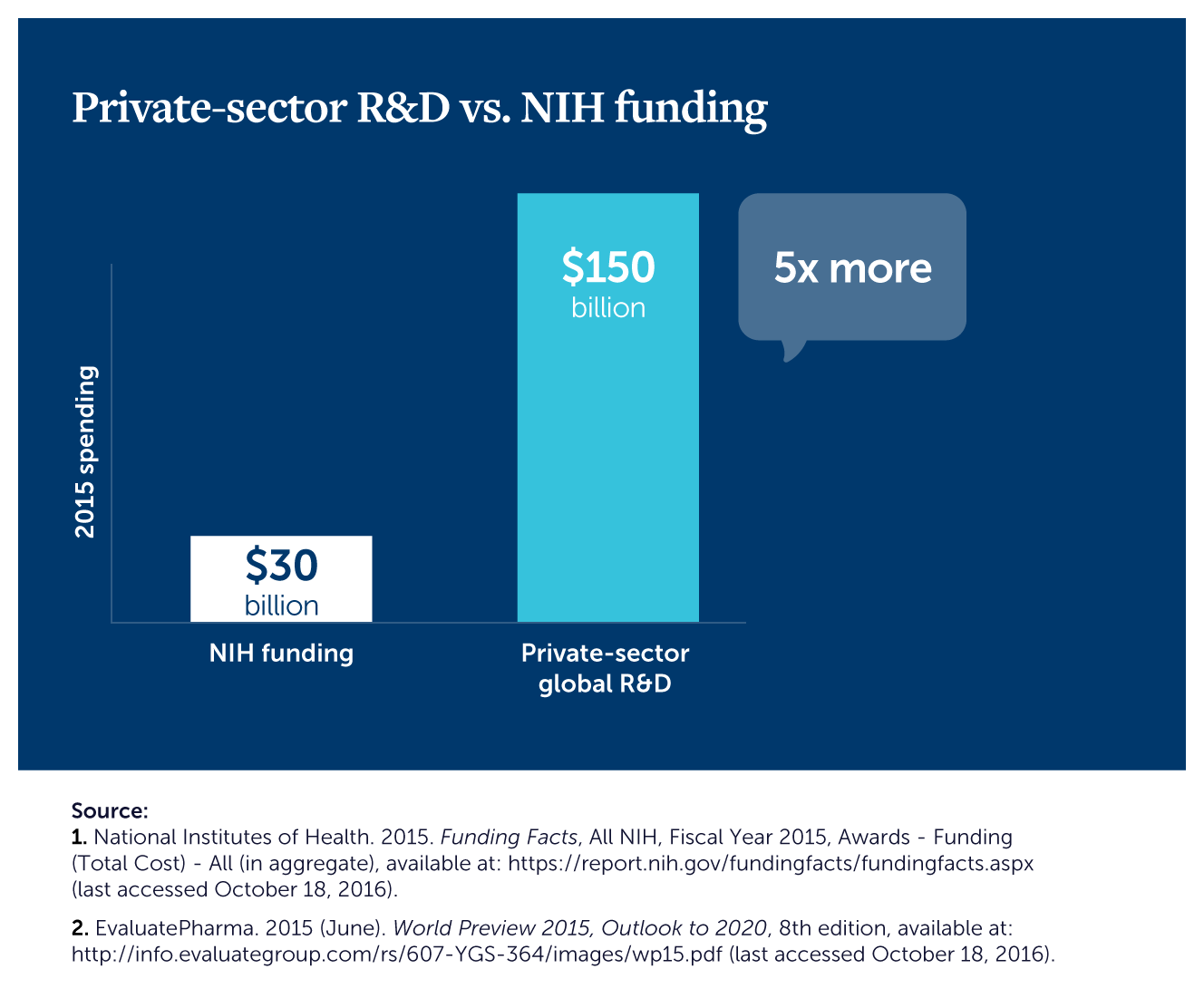

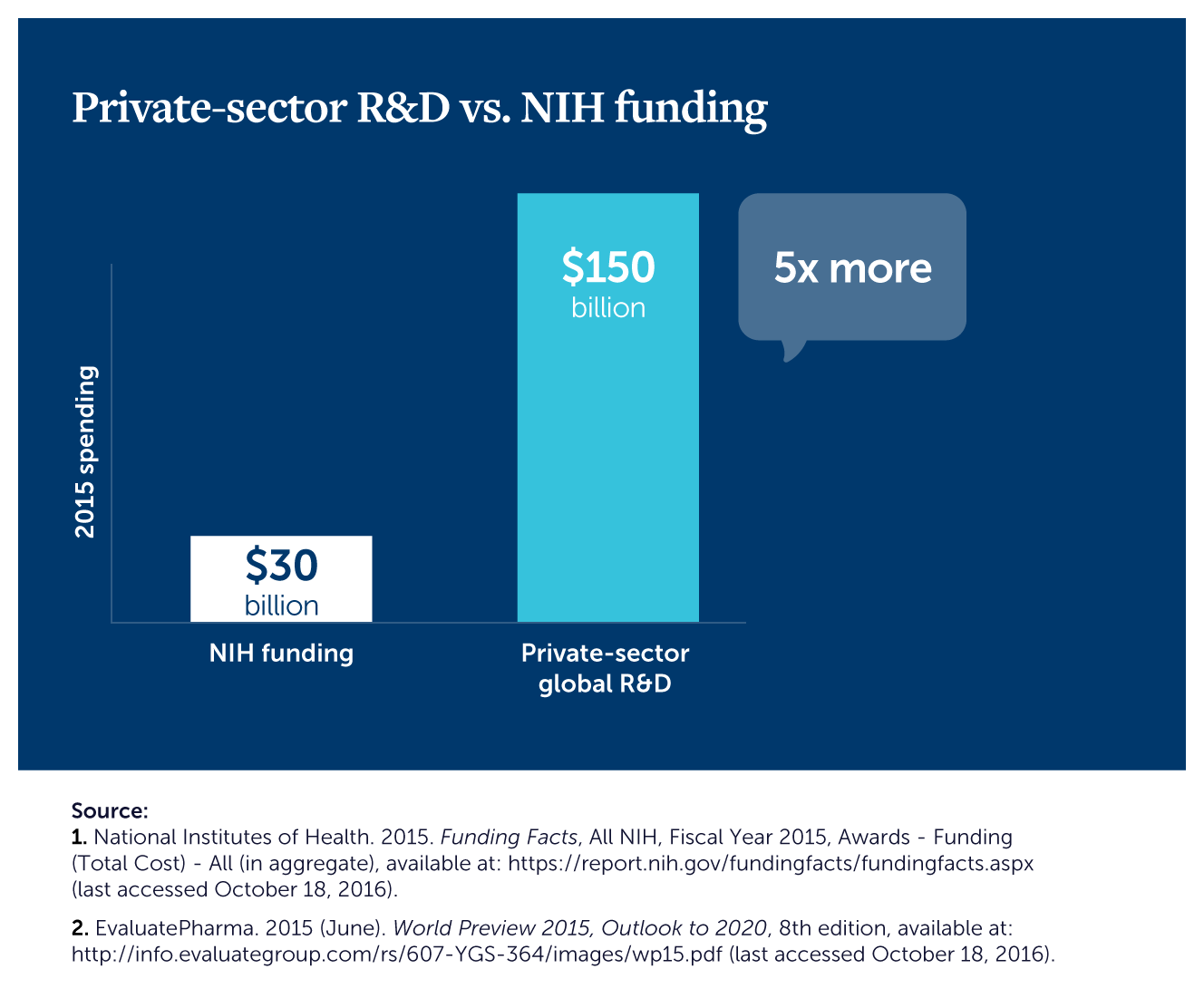

Image of the Day: Private Pharma Investment Dwarfs Federal NIH Funding

There’s a destructive campaign underway to encourage government confiscation of patents from pharmaceutical innovators and dictate the price for Remdesivir and other drugs. That’s a terrible and counterproductive policy under any circumstance, but particularly now that private drug innovators are already hacking away at the coronavirus. In that vein, this helpful image illustrates the vast disparity between private investment and National Institutes of Health (NIH) funding that some seem to think justifies patent confiscation, price controls or other big-government schemes:

Private Investment Dwarfs NIH Funding

May 26th, 2020 at 12:40 pm

Poll: Americans Overwhelmingly Agree with Trump’s Pandemic Deregulation Initiative

In our latest Liberty Update, we highlight the benefits of the Trump Administration’s deregulation effort, both pre-pandemic and going forward, and how a budding effort among Congressional leftists to impose a moratorium on business mergers would severely undermine that effort. Rasmussen Reports brings excellent news in that regard, as large majorities of Americans agree with Trump rather than hyper-regulatory leftists:

The latest Rasmussen Reports national telephone and online survey shows that 58% of likely U.S. voters approve of Trump’s decision to temporarily limit government regulation of small businesses to help them bounce back. Just 26% are opposed, while 17% are undecided.”

Sadly but perhaps predictably, those on the left stubbornly disagree:

The president’s action has triggered criticism from some. While 70% of Republicans and 59% of voters not affiliated with either major party agree with the decision to temporarily limit government regulation of small businesses, just 44% of Democrats share that view.”

Nevertheless, this is welcome news, as Americans maintain faith in what gave us the strongest economy in human history when the coronavirus pandemic suddenly hit – deregulation and letting America’s free market forces work.

April 27th, 2020 at 10:37 am

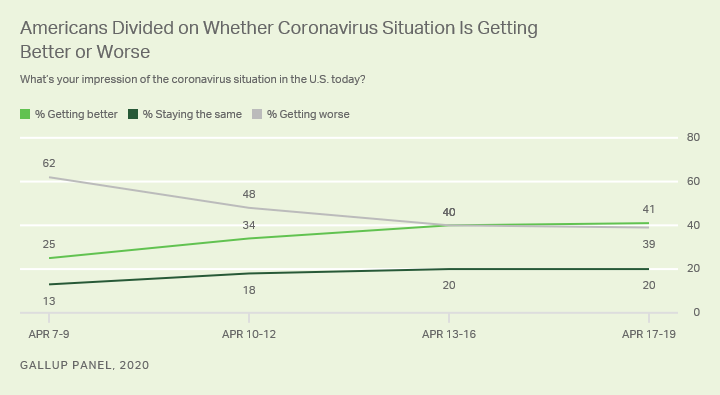

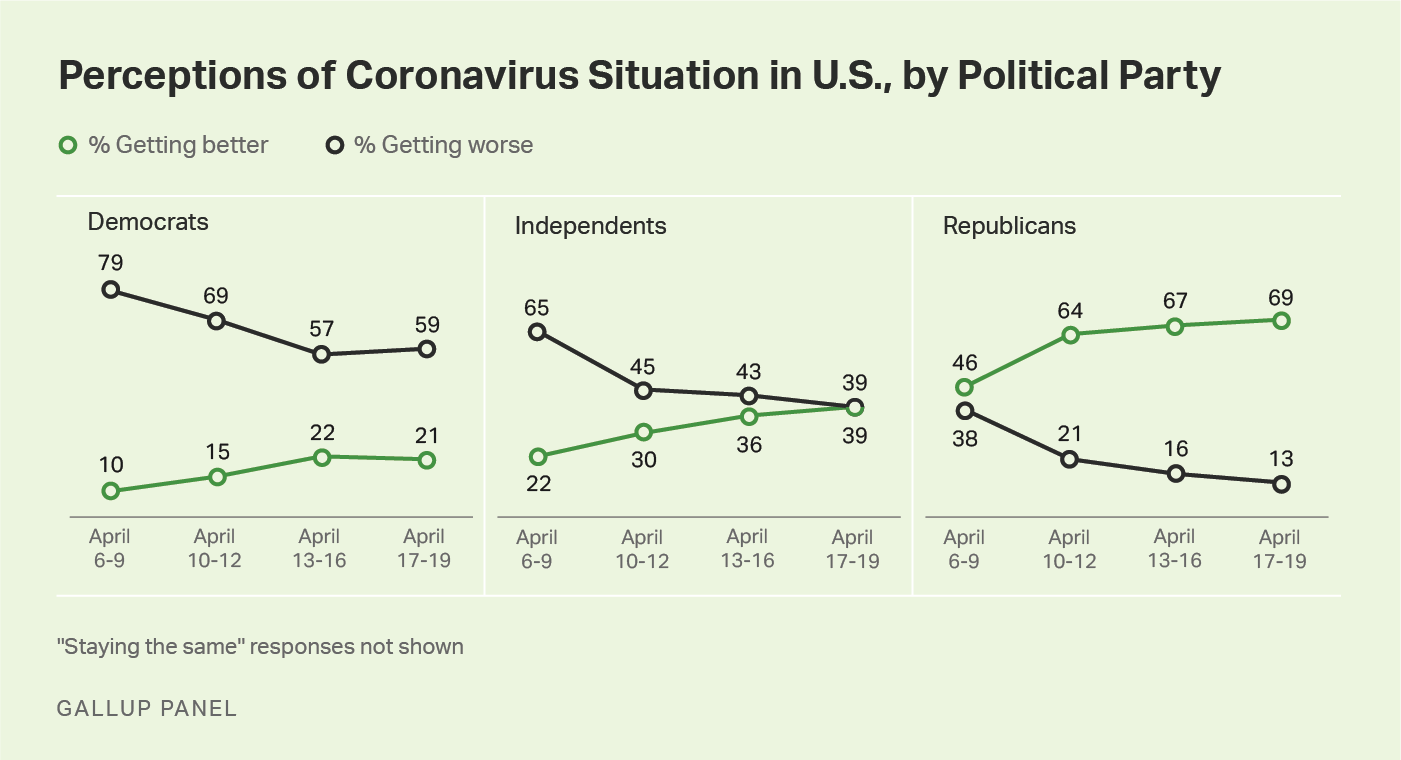

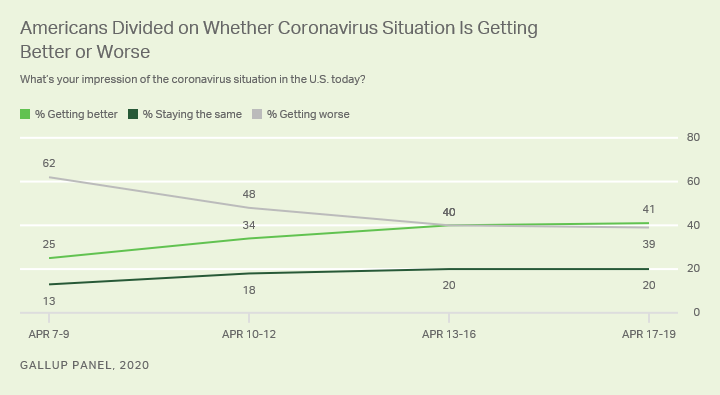

Image(s) of the Day: American Optimism Rising, According to Gallup

Gallup reports an encouraging upswing in American optimism amid the ongoing coronavirus pandemic, with a plurality now stating that the situation is improving:

American Optimism Rising

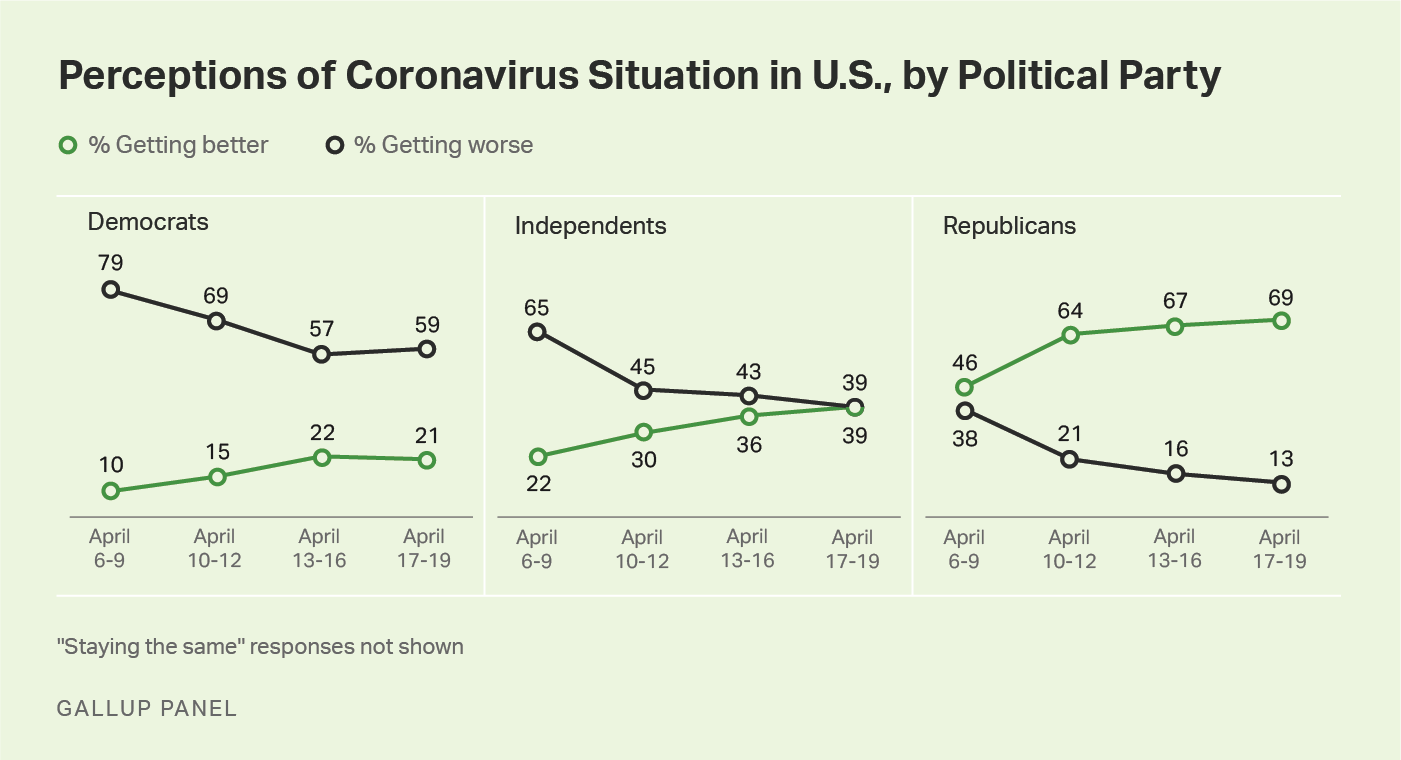

Interestingly, however, Democrats stand as an exception. Whereas they similarly expressed increased optimism, in recent days that trend has reversed. We’ll leave it to others to speculate on what explains that:

With One Exception

April 7th, 2020 at 10:16 am

Image of the Day: Peril of a “Buy American” Medical Mandate

CFIF has joined a broad coalition of fellow conservative and libertarian free-market organizations in opposing any proposed “Buy American” mandates on medicines, because they would place unnecessary sourcing requirements upon medicines and medical imputs purchased with federal dollars. That is the last thing that Americans need at the moment, not least because it doesn’t single out China in the way that some falsely assume, and the just-released coalition letter is worth reading in its entirety here.

In that vein, however, this image helpfully illustrates some of the logic behind the letter:

The Peril of a “Buy American” Order

March 30th, 2020 at 10:34 am

Some Potentially VERY Good Economic News

Here’s some potentially VERY good economic news that was lost amid the weekend news flurry. Those with “skin in the game,” and who likely possess the best perspective, are betting heavily on an upturn, as highlighted by Friday’s Wall Street Journal:

Corporate insiders are buying stock in their own companies at a pact not seen in years, a sign they are betting on a rebound after a coronavirus-induced rout. More than 2,800 executives and directors have purchased nearly $1.19 billion in company stock since the beginning of March. That’s the third-highest level on both an individual and dollar basis since 1988, according to the Washington Service, which provides data analytics about trading activity by insiders.”

Here’s why that’s important:

Because insiders typically know the most about their companies’ outlook, evidence of buying can signal corporate optimism and reassure investors, especially in times of turmoil. ‘I’ve never seen a number like that before,’ Dr. Nejat Seyhun said, referring to the buy-to-sell ratio that he calculated for the energy sector. Beyond Marathon Oil, insiders at companies including Exxon Mobil Corp., Sunoco LP and Continental Resources Inc. have also purchased shares. He said the increased level of buying may signal that energy executives believe ‘the oil price war is not going ot last too long.’ Dr. Seyhun’s research over the years has found that insider activity can be a ‘solid’ predictor of future returns. Stocks that insiders purchased during the 1987 stock market crash ‘bounced back,’ he said.”

We often malign insiders who dump stock before a downturn, so in this case we should welcome the signs of spring that insiders who tend to be most knowledgeable and possess actual skin in the game are heavily optimistic. As we noted in our Liberty Update commentary last week, that may signal a closer similarity to 1987’s crash, which witnessed a return to normalcy and prosperity soon thereafter, as opposed to 1929 or 2008. Staying the course on the lower-tax, less-regulatory environment that gave us the strongest economy in history when we entered this pandemic will help along the way.

March 13th, 2020 at 1:13 pm

Image of the Day: Patent Rights and U.S. Pharmaceutical Leadership

In our Liberty Update this week, we emphasize the critical role that strong patent rights play in U.S. pharmaceutical innovation. Although the U.S. accounts for just 4% of the world’s population and 24% of the global economy, we account for an astonishing 2/3 of new drugs introduced worldwide, as this helpful image illustrates perfectly:

Patent Rights = Global Pharmaceutical Innovation Leadership

Strong patent protections, along with our more market-oriented approach, have made America the world leader in pharmaceutical innovation. At a moment like this amid the coronavirus pandemic, it’s more important than ever to protect that legacy and oppose misguided efforts by some in Congress to undermine it.

CFIF Freedom Line Blog RSS Feed

CFIF Freedom Line Blog RSS Feed CFIF on Twitter

CFIF on Twitter CFIF on YouTube

CFIF on YouTube