Image of the Day: Myth Versus Fact Regarding Corporate Profits

An instructive myth-versus-fact visual when it comes to public assumptions regarding corporate profits, courtesy of AEI:

.

Myth Versus Fact: Corporate Profits

.

An instructive myth-versus-fact visual when it comes to public assumptions regarding corporate profits, courtesy of AEI:

.

Myth Versus Fact: Corporate Profits

.

Leftists constantly claim to support higher taxes, but then whine the loudest when they can put their money where their collective mouth is.

Under President Trump’s proposed framework, taxpayers in blue high-tax states would lose the writeoff for high state and local taxes that they currently enjoy. No wonder Chuck Schumer hates the idea of tax reform so much:

.

Blue State Tax Writeoffs

.

The Center for Individual Freedom (“CFIF”) yesterday joined with more than 20 leading conservative organizations on a letter urging Congress to pass historic, pro-growth tax reform.

The letter, which was organized by American Action Network’s Middle-Class Growth Initiative, reads in part:

“The outdated U.S. tax code, last overhauled more than three decades ago, has rendered American job creators less competitive in the global marketplace, slowed the growth of wages, and discouraged investment in local communities across our country. We write to urge you to support meaningful, transformative tax reform that will strengthen economic growth and enable greater prosperity for America’s job creators and middle-class families.”

Read the full letter here.

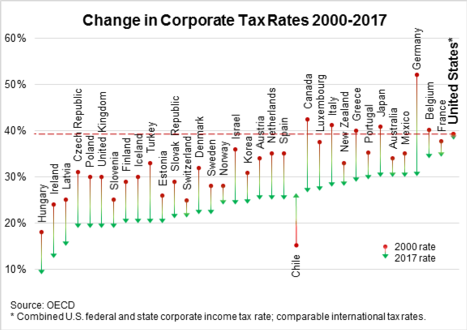

If you’re concerned about headwinds facing American international competitiveness, the first place to isolate and correct the problem is on corporate taxes. Courtesy of the Senate Joint Economic Committee, this shows in disturbing relief not only how the U.S. maintains the developed world’s highest rate, but also how global competitors continue to move in the right direction and leave us in the dust:

Stagnant U.S. Corporate Tax Rate

The good news is that comprehensive tax reform efforts are getting underway on both ends of Pennsylvania Avenue. It’s been three decades since we achieved significant reform under Ronald Reagan, and we mustn’t blow this golden opportunity.

As we move forward on President Trump’s tax reform proposal, which we highlighted in our latest Liberty Update, there’s encouraging news to report. According to Rasmussen Reports, Americans are so far supportive.

By a 46% to 32% margin, Americans support Trump’s proposal to repeal the unfair “death tax,” and by a 48% to 30% margin agree that tax cuts help the economy. Voters are also receptive to the plan “to eliminate most income tax deductions in exchange for a higher standard deduction,” which will simplify the code and benefit Americans in the lower filing brackets.

So there’s popular momentum, and now it’s up to Congress to finally get this done.

This week, we highlight how Donald Trump’s new tax outline offers a remarkably excellent framework for reigniting our economy, increasing prosperity for all Americans and making the U.S. more globally competitive.

Among other things, we note how the U.S. continues to suffer the industrialized world’s highest corporate tax rate, which Trump proposes to slash from 35% to 15%, better than the developed world average of about 25%. In The Wall Street Journal, former deputy editor and global affairs expert George Melloan observes how our unsustainably high corporate rate has slowly eroded America’s former economic dominance:

.

The slow economic growth in the U.S. over the past decade has resulted not from what the world has done to America but what America has done to itself, according to a Council on Foreign Relations study “How America Stacks Up.” It says that the U.S. ‘depends far more on the global economy than it did two decades ago, and international trade and foreign investment are increasingly vital to the U.S.’ It also finds that while the U.S. national economy remains by far the world’s dominant one, it has grown less so over that period.

One big reason is that ‘though the United States once had among the lowest corporate tax rates in the industrialized world it now has the highest.’ As the study confirms and Republican tax reformers in Congress understand, those high rates are not big revenue producers because multinationals choose not to bring home their overseas earnings for the IRS to grab.”

.

This captures again how critical it is that we finally achieve major tax reform for the first time since Ronald Reagan’s presidency, and stop the slow erosion of economic superiority that our crippling corporate tax code has caused.

Today’s eye-opening Image of the Day, courtesy of the Tax Foundation:

Americans' Tax Burden

Last November, Americans delivered a clear and important message to Washington, D.C.: Create more American jobs and increase investment in America’s aging infrastructure.

While roads, bridges and other public works projects are obviously important, President Trump has wisely recognized that a successful infrastructure policy must also include steps to stimulate private-sector infrastructure investment and job creation. Accordingly, as President Trump and Congress take steps to modify and reform the tax code, it is important that any changes being considered not undermine these private infrastructure initiatives.

Specifically, many American businesses currently rely on debt to fund infrastructure investments and create new jobs. Companies of all sizes in a variety of industries, including energy, internet broadband, telecommunications, manufacturing, transportation, retail and agriculture, routinely use debt to fund new technologies, build out and maintain infrastructure and hire and train American workers. Like other business expenses, interest paid on debt is an ordinary and necessary cost of doing business and has been tax deductible for over 100 years.

Unfortunately, some tax reform proposals seek to eliminate interest deductibility for businesses in favor of 100 percent expensing — allowing businesses to deduct the full value of capital expenditures in one year rather then spread out over many years.

Eliminating interest deductibility could immediately hinder many businesses’ ability to borrow, thereby impeding infrastructure improvement and expansion, as well as job growth. Small businesses, which create two out of three American private sector jobs and rely on debt financing, would be particularly hurt by any tax plan that eliminates interest deductibility, because they possess limited or no access to equity capital. Similarly, large businesses would need to delay investment to account for a larger tax liability over time.

While 100 percent expensing is a good idea that would help spark economic growth, one idea doesn’t need to be sacrificed in favor of the other. President Trump’s campaign tax proposal offered a wise compromise alternative.

Under his plan, businesses could chose either immediate expensing or interest deductibility, depending upon their particular needs. That would support economic investment and job growth by giving companies at least the choice between interest deductibility and 100 percent expensing. The Tax Foundation has determined that allowing companies to choose between the two options would contribute approximately $120 billion to our economy over ten years.

Going back to the infrastructure issue referenced above, electability between the two options also supports the President’s $1 trillion infrastructure plan, which relies on public-private partnerships, and Congressional leaders’ similar proposals, which include anticipated leverage ratios of up to five-to-one. Limiting interest deductibility could undermine those plans.

Perhaps most importantly, allowing companies themselves to choose between the two options facilitates passage of tax reform because proponents of either option need not be foes in the process.

There’s perhaps no greater defining mark of American politics today than the polarization that plagues our discourse. Acrimony has become the default posture of the major political parties and their supporters on even the most mundane issues.

There’s perhaps no greater defining mark of American politics today than the polarization that plagues our discourse. Acrimony has become the default posture of the major political parties and their supporters on even the most mundane issues.

Tonight, millions of Americans will tune into the final Presidential debate between Donald Trump and Hillary Clinton. Among the central topics should be the economy, which recent polling shows remains voters’ foremost concern.

Unfortunately, voters haven’t heard enough from either candidate on that topic during the first two debates.

Which is tragic, because this election itself has taken a toll on the economy. According to a recent poll of economists, rhetoric from both campaigns has had a negative impact on economic growth over the past few months. Accordingly, rather than continuing to argue about personal issues and mutual animosities, both candidates must do a better job of improving economic optimism and confidence by advocating pro-growth policies that will help us proper.

And in that vein, perhaps no issue merits focus more than comprehensive tax reform.

During the first debate, taxes and potential plans received brief discussion. Both candidates agreed that a significant problem exists with companies moving to other countries and protecting their earnings abroad from excessive U.S. taxes. Trump correctly pointed out that the reason many companies leave is that our corporate rate remains the highest in the developed world. Indeed, a recent Mercatus Center study highlighted how the increasing number of corporate inversions result from that inglorious distinction, and how lowering the rate will go a long way toward keeping American companies here so that they can create jobs and generate tax revenues domestically rather than abroad.

But more discussion and detail is critical. Over thirty years ago, on September 26, 1986, the Senate began debate over comprehensive tax reform legislation that the House of Representatives had approved. Incredibly, our tax code has not been reformed in a meaningful manner during the ensuing 30 years despite tectonic evolution of the U.S. economy during that time period. It’s therefore past time to modernize the code and reformed so as to help American businesses of all sizes, rather than continuing to hinder growth and opportunity.

And on that point, we need concrete plans from Mr. Trump and Secretary Clinton.

Demonstrating his own commendable leadership on this critical matter, Speaker of the House Paul Ryan recently stated that tax reform is his top priority in 2017. He rightly explained that the first thing that needs to be accomplished next year is “a budget that gets tax reform, that gets this debt and deficit under control.” Clearly, Speaker Ryan realizes that the American people welcome discussion about how the federal government can actually enact policies beneficial to the economy and their own individual finances. Whoever enters the White House this coming January must work with Congress to reform our tax code as soon as possible, which is precisely why we need to hear their ideas on how to best accomplish that.

To his credit, Trump has proposed a tax reduction for all businesses from 35 percent to 15 percent. And to her credit, Clinton acknowledges that lowering the corporate rate would encourage companies to repatriate funds stranded overseas. That’s obviously a step in the right direction, but the American people need to hear more specifics – a simplified code and lower rate, in particular – and a timeline for when they plan to enact that type of reform. While their rhetoric on the issue is occasionally encouraging, voters must learn which candidate will work to fix the tax code in order to improve our economy the fastest.

This election has obviously been among the most contentious in our nation’s history, and policy has too often taken a back seat to personality. While that may at times provide shallow entertainment, it’s time to put the personal attacks aside and hear more about both candidates’ visions for the economy. Hopefully, that will mean devoting more time toward discussing tax reform and economic growth, not bickering over issues that ultimately has little impact on Americans’ everyday lives and needs.

Inexplicably, the U.S. stubbornly maintains the developed world’s highest corporate tax rate. We also hold the inglorious distinction of taxing income earned overseas a second time, even after taxes were already paid in the nations where it was earned. Obviously, that only incentivize businesses to leave America for more hospitable foreign shores and take jobs with them.

A simple illustration courtesy of The Wall Street Journal drives home the point:

The U.S. system of worldwide taxation means that a company that moves from Dublin, Ohio to Dublin, Ireland, will pay a rate that is less than a third of America’s. A dollar of profit earned on the Emerald Isle by an Irish-based company becomes 87.5 cents after taxes, which it can then invest in Ireland or the U.S. or somewhere else. But if the company stays in Ohio and makes the same buck in Ireland, the after-tax return drops to 65 cents or less if the money is invested in America.”

When people wonder why over seven years of economic “recovery” doesn’t feel like a recovery at all, this is a leading reason. Our unsustainably high rate and double-taxation regime is simply unacceptable, but the good news is that the coalition favoring reform is bipartisan. That’s an encouraging sign regardless of who wins in November, but it’s time to finally get this done before even more businesses and jobs move overseas.

In an interview with CFIF, Michi Iljazi, Communications and Policy Manager for the Taxpayers Protection Alliance (TPA), discusses so-called corporate inversions, what they are and why the outdated U.S. tax code must be reformed to cure the underlining problem, as well as TPA’s latest Tax Day video.

In an interview with CFIF, Michi Iljazi, Communications and Policy Manager for the Taxpayers Protection Alliance (TPA), discusses so-called corporate inversions, what they are and why the outdated U.S. tax code must be reformed to cure the underlining problem, as well as TPA’s latest Tax Day video.

Listen to the interview here.

In an op-ed published yesterday in The Hill, CFIF’s Timothy Lee explains why President Obama and the Treasury Department are wrong on corporate tax inversions and the only way to prevent them is to enact comprehensive tax reform now.

The simple reality is that our corporate tax rate of 35% – the highest among OECD nations – jeopardizes every domestic corporation’s very survival in an increasingly competitive global economy. Moreover, because public corporations remain under a legal fiduciary duty to their shareholders to run the most efficient operation possible, America’s unsustainably high tax rate leaves them with little choice but to explore inversion opportunities.Tragically, even President Obama understands that reality. On several occasions, he has called for comprehensive tax reform that included lowering the corporate tax rate to a more globally competitive level. It defies logic and experience that the president called for lower tax rates out of some sentimental affection toward American corporations. Rather, he clearly understands that cutting America’s corporate tax rate allows domestic businesses a better chance of growing and competing on the international stage.To remedy the situation, Congress must take concrete steps towards comprehensive tax reform now…There is still enough time in 2016 to achieve a deal.

In an interview with CFIF, David R. Burton, Senior Fellow in Economic Policy at the Institute for Economic Freedom and Opportunity at The Heritage Foundation, discusses why the U.S. corporate tax rate makes it difficult for domestic companies to compete in the global economy, the Obama Administration’s efforts to stop companies from incorporating overseas and the urgent need for tax reform in the U.S.

Listen to the interview here.

CFIF’s Renee Giachino discusses the senseless legislative and PR push by the Obama Administration and many Congressional Democrats against U.S. corporations legally working to reduce their tax burden. Giachino explains that the most effective way forward is to reduce the U.S. corporate tax rate – currently the highest in the developed world – so American companies can better compete in the global economy.

In an interview with CFIF, Pete Sepp, Executive Vice President of the National Taxpayers Union, discusses Social Security, President Obama’s 2013 Budget proposal and the need for tax reform.

In an interview with CFIF, Pete Sepp, Executive Vice President of the National Taxpayers Union, discusses Social Security, President Obama’s 2013 Budget proposal and the need for tax reform.

Listen to the interview here.

A nefarious trend coming out of Washington, as reported by Politico:

Democrats on K Street are warning their corporate clients: Give to Republican challengers in the 2012 election, and you’ll regret it come tax reform time.

Lobbyists are getting that message from allies of powerful Democrats such as Senate Finance Chairman Max Baucus (D-Mont.), who is closely watching support for Rep. Denny Rehberg, a Republican challenging Sen. Jon Tester (D-Mont.). Baucus supporters fear that if Rehberg ousts Tester, Baucus could be next to face a serious Republican challenge in the state.

One K-Streeter close to the Baucus operation said the senator considers a gift to Rehberg a contribution against him. Another Democratic lobbyist told a client to take his name off a Rehberg fundraising event because it would be hurtful to his company, according to sources.

The case K-Streeters are making to their clients: It will be a hard sell next year to get Baucus’s support on business-friendly tax perks set to expire or the Bush-era tax cuts that must get through his committee.

Old D.C. hands that they are, the folks at Politico are quick to note that this is routine procedure on Capitol Hill, where the nexus between campaign contributions and favorable policy outcomes is an implicit rule of the game. That’s all true, of course, and Republicans have committed precisely these kinds of sins in the past. It doesn’t follow, however, that we have to accept it.

One of the most heartening aspects of the rise of the Tea Party has been the fact that there is now a powerful political coalition organized around a philosophy rather than a pecuniary interest. That philosophy is stripping power from Washington. And it’s precisely what’s needed here.

These kind of abuses are a powerful argument for the sagacity of a flat tax. Conservatives generally tend to focus on the economic benefits of a single income tax rate (which, because it eliminates so many distortions, are legion), but they may not pay enough attention to its virtues as a matter of political science. Having a single, across-the-board rate would keep politicians from turning the tax code into a byzantine apparatus meant to subsidize their friends and persecute their enemies. At that point, our elected officials might actually have to find an alternative to scaring their constituents into submission.