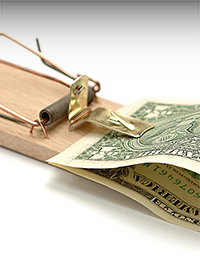

| The Tax-Shaming Trap |

|

|

By Betsy McCaughey

Wednesday, August 03 2016 |

Hillary Clinton and the media are goading Donald Trump again into releasing his tax returns, suggesting he's unwilling to pay his "fair share." Sadly, even a few of Trump's fellow Republicans are piling on. Their crazy premise: Paying the IRS more than you legally owe makes you a better person. That's nonsense. Donald Trump is wisely resisting calls to publicly air his tax laundry. He knows releasing his returns would suck him into a media feeding frenzy dragging on right up until Election Day, as opponents and reporters make a federal case out of every line of his returns and clobber him for paying anything less than the maximum rate. Call the assault "tax shaming" — demonizing high earners who take advantage of perfectly legal opportunities to lower their taxes. It's part of the Democratic Party's class warfare tool kit. This focus on Trump's personal tax returns distracts from the more important issue: tax reductions needed to jump-start our anemic economy. Yet Clinton and running mate Tim Kaine keep asking crowds to raise their hands if they think Trump is paying enough in taxes. "I don't see a lot of hands," Kaine jokes. Tax shamers are trying to entangle Trump in the same trap they used successfully against Mitt Romney in the 2012 presidential contest. President Obama, running for re-election, ran television ads hammering Romney for relying on "every trick in the book" to pay only 15 percent of his income in taxes — less than half the top rate at the time. Trump's onto the tax shamers' ploy, and even said on Sunday he thinks Romney lost the election because of it. Monday's New York Times editorial does it again, smearing Trump without even seeing his returns, insinuating the tycoon uses "tax breaks that ordinary voters do not exercise." Of course they don't — unless they're also real estate moguls building office towers and golf courses. It's a widely accepted best practice in the industry to minimize tax liability by using depreciation allowances, property tax deductions and other write-offs. No competent businessperson would do otherwise. But tax shaming is one way the political class has rigged the system to discourage outsiders — especially business leaders — from competing for political office. Most politicians don't mind releasing their tax returns because there's so little to see. Voters can get a clear picture of the choice between Clinton and Trump by looking at the financial disclosures they're legally required to release. Clinton's is a mere 11 pages — almost all speaking fees and royalties from books she wrote about herself. She's in the self-promotion business. Compare that with Trump's 104-page disclosure. His lists a whopping 185 income-producing business ventures, including office and apartment buildings, resorts and other companies around the world, as well as fees he earns managing other owners' properties. He's a builder and job creator, not just a braggart like Clinton. Same is true of another business titan who cleverly managed to dodge the tax-return trap: New York City Mayor Michael Bloomberg. Expecting that his billions in business activities would invite unfair criticism, he refused to disclose his tax rate or how much he paid, and allowed reporters to see only his highly redacted returns and just for a few minutes without making copies. When the press objected that all other candidates were releasing their full returns, he said "That's fine. They don't make anything." Tax returns disclose how business owners like Bloomberg and Trump make their money. While Hillary Clinton assails Trump for not releasing his tax returns, she's withholding the transcripts of her paid speeches — keeping under wraps what she said to make her money. Scrutiny of candidates' tax returns has become a witch hunt, where legitimate business success and standard accounting practices are punished with suspicion. So far, Donald Trump's been too smart to take the bait. ---------------------------------------------------------------------------------------------------------------------------------------- Betsy McCaughey is chairman of the Committee to Reduce Infection Deaths and a senior fellow at the London Center for Policy Research and author of "Government by Choice: Inventing the United States Constitution." |

Related Articles : |