| IRS Rewrites ObamaCare to Increase Taxes |

|

|

By Ashton Ellis

Thursday, September 13 2012 |

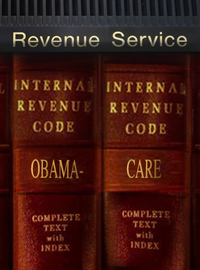

First the Supreme Court rewrote President Barack Obama’s signature health reform law to save it from the Constitution. Now the Internal Revenue Service claims its new rule can interpret the law in a way that violates its text and history. The latest outrage against common sense is an IRS rule finalized on May 23. The rule makes tax credits available to participants in federally run health insurance exchanges created under the Patient Protection and Affordable Care Act (aka ObamaCare). But while Section 1311 of ObamaCare allows tax credits to certain people in state-run exchanges, Section 1321 – the section regulating federally run exchanges – does not. Nevertheless, the new IRS rule specifies that tax credits will be available through exchanges “established under section 1311 or 1321” of ObamaCare. By rewriting ObamaCare without statutory authorization, the IRS is engaging in an illegal power grab that will cost taxpayers billions. As regulation experts Jonathan Adler and Michael Cannon explained in testimony before Congress, one of the central arguments used to promote ObamaCare was that passing it would not add a penny to the federal deficit. The ability to make that argument was based on shifting the cost of creating and running the health insurance exchanges onto states. Here is where liberals in Congress got cute. Instead of simply forcing states to create exchanges – which would have heightened opposition inside and outside Washington – they coupled the mandate with an enticement. Voluntary compliance would trigger “premium-assistance tax credits” available to people in state-run exchanges. The tax credits would act as a subsidy paid by the Treasury Department on behalf of an eligible participant purchasing health insurance from a private provider in the exchange. When ObamaCare was working its way through Congress, Senate Finance Committee Chairman Max Baucus (D-MT), a lead sponsor of the law, confirmed the tax credit enticement strategy. When questioned about the difference between the benefits to people in state versus federally run exchanges, he said, “And [for] states – an exchange is, essentially is tax credits.” However, if states refuse to create an exchange, ObamaCare empowers the Secretary of Health and Human Services to do so. But those pushing ObamaCare toward passage didn’t count on almost thirty states eventually refusing to create exchanges. With the federal government stepping in to create and run sixty percent of the nation’s newly mandated exchanges, gone is the accounting gimmick of cost-shifting the spending increase onto the states. The hit to taxpayers will be bad enough, but the new IRS rule makes the spending problem even worse. By injecting tax credits into federally run exchanges, the IRS is requiring the Treasury Department to subsidize health insurance purchases in thirty jurisdictions that ObamaCare, by its terms, does not cover. In analyzing the new IRS rule, the Congressional Budget Office estimates that if no states create exchanges, the cost of the new rule will total $1 trillion in new spending over the next ten years. With sixty percent of the states opting not to participate, federal taxpayers are looking at hundreds of billions of dollars added to the deficit. And all this without one shred of authority from ObamaCare’s text or legislative history. The quickest way to rein-in the IRS is for Congress to exercise its authority under the Congressional Review Act. It allows Congress to kill a bureaucratic rule from going into effect by passing a joint resolution of disapproval. SJR 48 by Senator Ron Johnson (R-WI) would do just that. Recently, the bill received the support of forty-six conservative and free market organizations (including CFIF) opposed to the IRS’s illegal power grab. The Supreme Court failed to take the text and intent of ObamaCare seriously, and now the IRS is following its lead. Unless Congress reasserts control over the lawmaking function, it may soon find itself as the least important branch of government. |

Related Articles : |