| Obama’s IRS Return Shows His Tax Hypocrisy, Current Debate Shows Urgent Need for Corporate Tax Reform |

|

|

By Timothy H. Lee

Thursday, January 26 2012 |

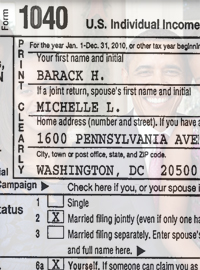

In his State of the Union speech, Barack Obama lectured those whom he hadn’t already bored to stupor with his usual onslaught of platitudes – you probably had no idea that “teachers matter” until he said so – that anyone earning over $1 million should pay at least 30% to government. Oh, and another thing – no deductions allowed: “If you make more than one million dollars a year, you should not pay less than thirty percent in taxes… In fact, if you’re earning a million dollars a year, you shouldn’t get special tax subsidies or deductions.” But guess what, those of you among the servile class. Obama unsurprisingly doesn’t practice the same class warfare that he preaches. In the most recent year available, Obama’s income totaled $1,795,614. So unlike Americans earning as little as $200,000 whom he habitually defines as “millionaires and billionaires,” he actually is one. But what did Obama himself pay in taxes? Approximately $454,000, which amounts to about 25% of his income. As for deductions that he says millionaires shouldn’t get, Obama certainly took his share. In fact, he claimed almost $400,000 worth, which is almost as much as his total tax payment. But hey, at least Obama carries his “fair share” better than that miserly Mitt Romney, right? Not necessarily. Amid the curious media feeding frenzy over Romney’s 15% effective tax rate - “curious” because the same media refrained from obsessing over John Kerry’s 13.1% rate in 2004 - the fact that his investment income is double taxed was ignored. Namely, before dividend or capital gain income is taxed at the current 15% rate, those dollars are first taxed under our current tax regime at the prevailing 35% corporate rate. Accordingly, since the federal government first taxes such income at the 35% corporate rate, and then again upon receipt at 15%, the top marginal rate actually reaches 44.75%. Making matters worse, America’s 35% corporate tax rate remains the second-highest in the world among developed countries. Not only does that punish investment in the double-taxation manner described above, it significantly disadvantages U.S.-based companies vis-à-vis foreign competitors. When we last reformed our tax system 25 years ago, our corporate rate was actually among the lowest in the industrialized world. Since that date, however, we have fallen to next-to-worst. Moreover, businesses and “millionaires and billionaires” aren’t the only ones suffering under excessive corporate tax rate. According to Ernst & Young, America’s high corporate rate reduced wages and benefits for U.S. employees by some $100-$200 billion over the past decade alone. And according to the Heritage Foundation and Milken Institute, reducing that rate even to the Organization of Economic Cooperation and Development (OECD) average of 25% would create 500,000 to 2.2 million jobs and add $2,484 in additional income for the average family of four each year. Fortunately, there is some good news to report from Obama’s State of the Union. Amid his assault, he actually suggested a willingness to pursue corporate tax reform: “We should start with our tax code. Right now, companies get tax breaks for moving jobs and profits overseas. Meanwhile, companies that choose to stay in America get hit with one of the highest tax rates in the world. It makes no sense, and everyone knows it. So let’s change it.” Americans agree. According to Gallup, Americans favor corporate tax reform that would help stem the outflow of businesses and jobs by an 82% to 15% margin. The question now is whether we act quickly while a rare political consensus exists. More divisive rhetoric and class warfare from Obama won’t accomplish anything. He has exposed himself as a hypocrite by not conducting his own affairs in the manner that he demands from the rest of America, but he can make amends by converting his more positive words to action. It’s up to us to ensure that Congress and the White House make this happen, to achieve a rare convergence between their own political interests and the nation’s actual welfare. |

Related Articles : |