| Gavin Newsom’s $32 Billion California Deficit Versus Ron DeSantis’s $22 Billion Florida Surplus |

|

|

By Timothy H. Lee

Thursday, May 18 2023 |

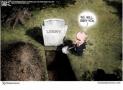

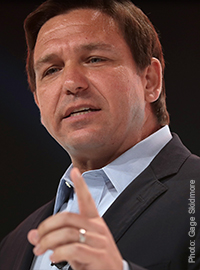

As the economic climate deteriorates amid Biden Administration mismanagement, the Federal Reserve announced this week that consumer debt rose to an all-time record in the first quarter of this year and surpassed $17 trillion for the first time. It also reported that more Americans find it difficult to remain current on car, credit card and mortgage payments, with debt balance delinquencies up sharply compared to one year ago. Making matters worse, regulators at the federal and state levels continue to needlessly target short-term consumer finance lenders, which only drives struggling Americans to fall deeper into credit card debt, seek illegal loansharks, bounce checks or simply fail to pay important bills. Even before the Covid pandemic, the federal government estimated that nearly 40% of American families didn’t possess sufficient savings to cover even $400 in emergency expenses, while 54% of military personnel lived paycheck-to-paycheck every month, so constricting consumers’ lending options is hardly the appropriate government response. Instead of restricting consumer access to legal, above-board finance options, elected leaders should be facilitating it. Meanwhile, on the subject of accumulating debt, we’re witnessing a tale of two states – California versus Florida – experiencing very different budgetary fortunes as a result of contrasting leadership models. While high-tax and hyper-regulatory California suffers deepening deficits, tax-cutting and pro-market Florida enjoys budget surpluses. California Governor Gavin Newsom, who makes a bizarre habit of attempting to troll his more successful gubernatorial counterpart Ron DeSantis of Florida, was forced to acknowledge this week that California’s budget deficit will come in much higher than previously projected. At a press conference this week in Sacramento, Newsom admitted that the state’s deficit under his leadership has ballooned to almost $32 billion, which is $9 billion higher than just four months ago in January. In trademark slippery fashion, Newsom spun his expanding budget deficit as “a $31.5 billion challenge,” before scapegoating Congressional Republicans and climate change for the deteriorating situation under his watch. In contrast, Florida under Governor Ron DeSantis enjoys record budget surpluses despite – or more likely because of – multiple rounds of tax cuts, while the state’s future trajectory remains decidedly more upbeat than California’s: Even with historic state spending and tax cuts over the last two budgets, record reserves still exist. Florida’s tax system continues to produce revenue at a breakneck pace, with actual collections beating the estimate in each month over the last two years. Lately, the magnitude of the overage has been staggering. In the last three months of FY 2021-22 (April – June), collections exceeded estimates by $2.545 billion (23.9 percent). Now, the new Long-Range Financial Outlook, recently adopted by the Joint Legislative Budget Commission, adds estimated expenditures to the equation. The result is by far the largest projected General Revenue (GR) budget surplus ever forecast by the Outlook – $13.5 billion for the next budget (FY 2023-24). The surplus grows to $14.6 billion in FY 23023-25 and $15.5 billion in FY 2025-26. Perhaps DeSantis can repay Newsom’s provocative visit to Florida by touring California to provide helpful tutorials on fiscal leadership. At the federal level, meanwhile, Joe Biden routinely repeats the false claim that his own budgetary wizardry has reduced the nation’s debt by $1.7 trillion, often in his creepy trademark whisper for emphasis. The truth is that deficits temporarily fell because Covid emergency spending measures expired, and they would’ve been higher if Biden had been granted his original “Build Back Better” spending wish list. In any event, there’s bad debt news for Biden as he prepares for his 2024 reelection effort, depriving him of even that false talking point. Namely, federal deficits are on their way back up in fiscal 2023, as economic cooling slashes incoming receipts while Biden’s spending agenda remains out of control. According to the Congressional Budget Office (CBO), the deficit hit $1.1 for the first half of the current 2023 fiscal year, which is a 63% increase from one year ago. With a slowing economy reducing incoming tax revenues and higher debt payments due to rising interest rates, the deficit outlook continues to worsen. And with Joe Biden stubbornly refusing spending moderation as the nation’s debt limit approaches, the situation appears likely to worsen before it improves. The good news is that a path to fiscal recovery exists. Florida, with the nation’s third-largest population, illustrates that fact. Creating a pro-business climate and reducing tax burdens cultivates budgetary health. Higher taxes and more regulation, in contrast, discourage growth and deepen deficits. The outstanding question is whether Americans will choose to correct course or continue down the road to fiscal Armageddon. |

Related Articles : |