| If ObamaCare Is a Tax, Did It Violate the Origination Clause? |

|

|

By Ashton Ellis

Thursday, September 20 2012 |

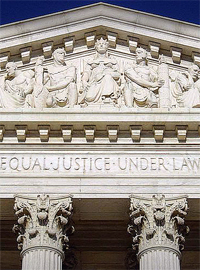

This summer, five justices on the United States Supreme Court rewrote ObamaCare to say that its individual mandate to buy health insurance is a tax, not a penalty. But if that’s true, it raises another constitutional question that the Court did not address. Did the process of passing ObamaCare into law violate the Origination Clause? A lawsuit filed by the Pacific Legal Foundation argues yes. PLF’s argument is straightforward. In order for a new tax law to be valid, it must begin (originate) in the House of Representatives. So says the Origination Clause in Article I, Section 7, clause 1 of the Constitution: “All Bills for raising Revenue shall originate in the House of Representatives,” but that “the Senate may propose or concur with amendments as on other bills.” Daniel Himebaugh, one of the PLF attorneys in the case, Sissel v. Department of Health and Human Services, tells CFIF that, “The reason the Framers of the Constitution required laws that create taxes to originate in the House is because House members are elected from local districts every two years. Thus, they are the politicians who are closest to the voters; the people affected by new taxes.” Recall that the history of ObamaCare did not follow this simple constitutional process. The bill that would become the Patient Protection and Affordable Care Act (“ObamaCare”) was originally introduced and passed unanimously by the House of Representatives in September 2009. It was H.R. 3590, and its title was then the “Service Members Home Ownership Tax Act of 2009.” According to the bill’s text, it would “amend the Internal Revenue Code of 1986 to modify first-time homebuyers’ credit in the case of members of the Armed Forces and certain other Federal employees.” As PLF’s complaint points out, “H.R. 3590 had nothing to do with health insurance reform.” Nevertheless, Senate Majority Leader Harry Reid (D-NV) “amended” the bill in November 2009 by completely replacing the contents of H.R. 3590 with ObamaCare’s provisions, including the individual mandate. To reflect the transformation from homebuyers’ credits to health care reform, Reid renamed the bill the “Patient Protection and Affordable Care Act.” The Democrat-controlled Senate then passed ObamaCare on party lines, followed by the House. So as the congressional record clearly shows the ObamaCare provision that ultimately became a tax originated not in the House, but in the Senate. Thus, it violates the Origination Clause and is unconstitutional. If this seems simple, it is. But the reason the Supreme Court never really considered this issue in its recent ObamaCare decision is because the Obama Administration expressly denied that the individual mandate was a tax. That was necessary because President Obama himself had promised that his brand of health care reform would not raise taxes. So the individual mandate became a penalty, not a tax. And since it wasn’t argued as a tax, no one, including the Supreme Court, spent any time seriously considering whether as a tax the individual mandate followed the proper constitutional procedure for creating new taxes. Instead, Chief Justice John Roberts wrote a controversial opinion in National Federation of Independent Businesses v. Sebelius that split the difference between the conservative and liberal blocs. Siding with the conservatives, Roberts agreed that ObamaCare’s individual mandate was an unconstitutional abuse of Congress’ power to regulate economic activity under the Commerce Clause. But with the liberals he agreed that the mandate is allowed if interpreted as an exercise of Congress’ power to tax. The result is a fractured opinion that leaves two key questions about ObamaCare unanswered. The first is whether NFIB really holds that ObamaCare’s individual mandate is unconstitutional under the Commerce Clause. The reason for doubt is because Roberts’ opinion seems to make the joint conservative dissent into the Court’s majority opinion on this important point. If it does, then NFIB can be cited as the first major restriction on federal regulatory power in almost twenty years. The second question is whether Roberts’ opinion interpreting the mandate as a tax means that the Origination Clause’s strict procedure will come into play. Taking Roberts and the liberal justices at their word demands that they now consider whether rewriting ObamaCare to survive the Commerce Clause challenge only exposes the law as an unconstitutional tax. These are the questions the Pacific Legal Foundation poses in its lawsuit. They demand honest answers. |

Related Articles : |