|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

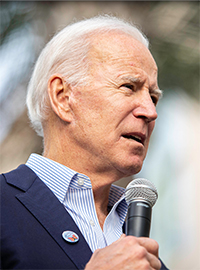

"Soon the government might shut down your car.President Joe Biden's new infrastructure gives bureaucrats that power.You probably didn't hear about that because when media covered it, few mentioned the requirement that by 2026, every American car must 'monitor' the driver, determine if he is impaired and, if so, 'limit vehicle operation.'Rep. Thomas Massie objected, complaining that the law makes government…[more]

|

|||||

|