| Inversion: America Has Gone From Attracting Global Business to Penalizing It |

|

|

By Timothy H. Lee

Thursday, September 25 2014 |

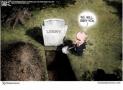

Throughout our nation's history, Americans have taken justifiable pride in cultivating a domestic climate that attracts innovators, entrepreneurs and businesses from across the globe. In recent years, however, our tax laws and federal regulations have eroded our international competitiveness. Paradoxically, that has occurred during a period in which increasing globalization demands improvement, not regression. Unfortunately, new rules announced by the Obama Administration will make the situation worse, not better. Instead of fixing the problem, they seek to compound it. For a sense of our worsening peril, look no further than a new report from the nonpartisan Tax Foundation. This month, it released its 2014 International Tax Competitiveness Index comparing the merits of the world's 34 developed economies: "Taxes are a crucial component of a country's international competitiveness. In today's globalized economy, the structure of a country's tax code is an important factor for businesses when they decide where to invest. No longer can a country tax business investment and activity at a high rate without adversely affecting its economic performance. In recent years, many countries have recognized this fact and have moved to reform their tax codes to be more competitive. However, others have failed to do so and are falling behind the global movement." And for the U.S., the Index's verdict is unwelcome: "The United States places 32nd out of the 34 OECD countries on the ITCI. There are three main drivers behind the U.S.'s low score. First, it has the highest corporate income tax rate in the OECD at 39.1 percent. Second, it is one of the only countries in the OECD that does not have a territorial tax system, which would exempt foreign profits earned by domestic corporations from domestic taxation. Finally, the United States loses points for having a relatively high, progressive individual income tax (combined top rate of 46.3 percent) that taxes both dividends and capital gains, albeit at a reduced rate." We even trail such nations as Greece, Italy, Spain, Hungary, Korea, Chile, Turkey and next-door Mexico. So how is the Obama Administration responding to this deepening problem? With its reverse-Midas approach, regrettably. Desperate for another wedge issue to boost his depressed public approval rating, Obama is opting to demonize and target multinational corporations rather than entice them with more hospitable reform. Specifically, Obama's Treasury Secretary Jack Lew announced this week that the Administration would target so-called tax inversions, making it more difficult for U.S. companies to engage in international mergers and incorporating in lower-tax countries while continuing operations here in America. The Obama Administration claims to be targeting "unpatriotic" (a term that liberals use profusely while labeling it intolerable whenever applied to themselves) corporations that relocate for tax purposes. In reality, however, the obvious practical effect will be to discourage reinvesting profits earned overseas here in America. That's because, as noted above, the U.S. is one of the few countries that double-taxes at the U.S. rate overseas profits that were already taxed by the nation in which they were earned. Inversion agreements understandably seek to avoid that, but the Obama Administration wants to build a metaphorical Berlin Wall to restrain them. It must be emphasized that these so-called inversions do not mean that companies somehow escape paying their fair share of taxes earned here in America. They are taxed, and continue to be taxed after inversion, at the elevated U.S. rate on earnings here in America. Inversion simply allows them to avoid the punitive double-taxation we unreasonably impose on overseas earnings. Accordingly, the Obama Administration's new initiative will only make our already-punitive corporate tax system even more so. Instead of improving the situation during this difficult economic period, it will make the situation worse. Perhaps the most tragic aspect is that this is a rare issue in which bipartisan agreement exists. Prominent Democrats such as Senator Ron Wyden (D - Oregon) have joined Republican colleagues to advocate lowering the corporate tax rate and simplifying the code. But the increasingly desperate and partisan Obama Administration will not play ball. The last time we overhauled our corporate tax code was 1986, when we reduced the rate from 46% to 34%. Since that time, almost every other developed country has cut its tax rate, reducing the worldwide average from 48% in 1986 to approximately 25% today. That leaves us with the developed world's highest rate, with the current administration inexplicably opting to exacerbate the problem. The healthier course would be to recognize the root cause of business departures and correct the deteriorating situation via bipartisan corporate tax reform nearly three decades overdue. The question becomes whether American voters and leaders from both parties demand accountability and corrective action from the executive branch. |

Related Articles : |