|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||||

|

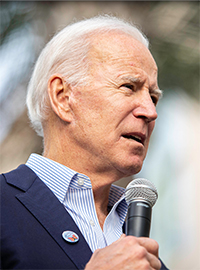

"The Federal Reserve must not make President Joe Biden's mistake when choosing between inflation and the economy.Three years ago, when confronted with this choice, the Biden administration chose economic growth at all costs -- literally, spending trillions to stoke the economy. The result has been (and continues to be) the inflation that won't go away, even as the economy now appears to be slowing…[more]

|

|||||

|