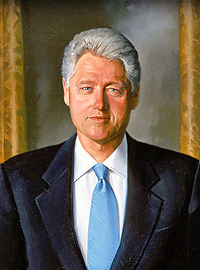

| Correcting the Clinton Record: Tax Cuts, Spending Restraint, Moderation |

|

|

By Timothy H. Lee

Thursday, September 06 2012 |

You never want to catch whatever Bill Clinton is spreading. Accordingly, here’s some precautionary intellectual inoculation. This week, Clinton attempted to rescue the political fortunes of a current president whose policy choices contrast sharply with his own. Instead of a rescue, however, Clinton may have simply highlighted the dichotomy between the two presidencies. Whereas Clinton grudgingly acknowledged, “The era of big government is over,” Barack Obama doubled down with, “You didn’t build that! Somebody else made that happen!” Nevertheless, it is important that we recall the Clinton presidency more accurately than he and many liberals wish to portray it. First, Clinton was a tax-cutter. Liberals currently determined to raise tax rates often reference the slightly higher top rate under Clinton (39.6% versus 35% today), as if that was what brought budget surpluses and economic growth. They neglect to mention that Clinton also cut taxes. In fact, he cut the capital gains tax rate, which is perhaps the most common target of liberal scorn. In 1997, Clinton and the Republican Congress reduced the rate from 28% to 20%, and just as predicted by the Laffer Curve liberals love to hate, the result was an increase in revenues to the federal government. Moreover, it is important to note that Clinton’s slight increase in the top income tax rate occurred in his first year in office. In other words, during the first two-year period that was so disastrous that American voters elected a Republican Congress for the first time since 1954. Thus, the unsuccessful portion of Clinton’s tenure witnessed tax hikes, whereas the more successful latter years for which he is often remembered brought tax cuts. Second, liberals constantly demand a return to the Clinton-era top income tax rate, but never Clinton-era levels of spending. The fact is that spending restraint, not higher taxes, account for the late-1990s budget surpluses. In the year 2000, the federal government spent $1.77 trillion and received $1.88 trillion in revenues. Compare that to 2011, when the federal government spent $3.63 trillion and received $2.31 trillion. Does any reasonable person believe that government was too small in 2000, or twice as effective in 2011 after spending approximately doubled? Of course not. Additionally, federal spending under Clinton and the Republican Congress fell to 18.2% of gross domestic product (GDP) in 2000, versus approximately 25% of GDP under Obama. Based on those spending numbers, note that if we returned to Clinton-era spending with today’s tax revenues, we’d enjoy a surplus of nearly $600 billion. Moreover, for all of liberals’ demonization of the 2001 and 2003 tax cuts, federal revenues actually reached their all-time high in 2007. If tax cuts were the problem, that wouldn’t have been the case. Indeed, the 2007 deficit (the last year in which Republicans controlled Congress and the White House) was a miniscule $161 billion. That was already several years after the Bush tax cuts, as well as the year in which war spending in Iraq and Afghanistan peaked. So liberals can’t scapegoat tax cuts or the “unfunded” Iraq and Afghan wars for today’s deficits and debt. Third, the so-called “Clinton surpluses” didn’t arrive until 1998, four years after Newt Gingrich and the Republicans captured Congress for the first time in four decades, and six years after Clinton was elected. Given the fact that Congress controls the budget under our Constitution, it is therefore disingenuous for Clinton and his apologists to claim sole credit. Fourth, the celebrated 1990s stock market boom effectively began almost precisely when Republicans claimed Congress in 1994, at which point the Dow Jones Industrial Average stood under 4,000. Six short years later, the Dow had ascended past 10,000. Finally, since the issue has returned to the forefront, a note about the Clinton impeachment from personal experience litigating labor and employment cases. Clinton was a defendant who lied under oath in a sexual harassment suit. Not even Richard Nixon did that, yet he was forced from office. Regardless, one of the most effective ways that a sexual harassment victim can establish quid pro quo sexual harassment is to demonstrate that other women who complied with the harassing defendant were rewarded, whereas the victim was penalized for her noncompliance. If the defendant harasser, whether a CEO or mid-level supervisor or even the President of the United States, is allowed to lie about his behavior under oath in a legal proceeding because “it’s just about sex,” then sexual harassment becomes that much tougher to establish. In Clinton’s case, the alleged sexual harassment victim was Paula Jones and the alleged beneficiary of compliance with Clinton’s advances was Monica Lewinsky. Talk about a real “war on women.” Clinton was rightfully impeached – as well as officially disbarred, it should be noted – and it is disgraceful that those who claim to support women’s rights so blindly and hypocritically excuse his transgressions. Bill Clinton remains a charming figure to many Americans. But that charm cannot obscure the reality that whatever political success he enjoys resulted from a corrective electoral “shellacking” that forced him to behave more conservatively. Obama, in contrast, has doubled down on what triggered his own 2010 shellacking. As a consequence of that choice, he may soon realize that 2012 is no 1996. |

Related Articles : |