| Tax Week: Bernie Sanders Didn't Practice What He Preaches |

|

|

By Timothy H. Lee

Thursday, April 21 2016 |

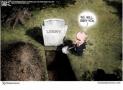

Bernie Sanders asserts with religious fervor that "the rich" must pay more in taxes. Except when it comes to Sanders himself, apparently. It all makes for a satirical tale paralleling George Orwell's "Animal Farm" in which "all animals are equal, but some animals are more equal than others." Sanders certainly preaches a good game at campaign rallies and on his official website: "The issue of wealth and income inequality is the great moral issue of our time, it is the great economic issue of our time, and it is the great political issue of our time. The reality is that since the mid-1980s there has been an enormous transfer of wealth from the middle class and the poor to the wealthiest people in this country. That is the Robin Hood principle in reverse. That is unacceptable and that has got to change." So how does Sanders propose to bring about the type of change he advocates? Again according to his own campaign website under the heading "Making the Wealthy, Wall Street, and Large Corporations Pay Their Fair Share," he'll pursue that goal by ratcheting up taxes on wealthier Americans: "At a time of massive wealth and income inequality, we need a progressive tax system in this country that is based on the ability to pay... If we are serious about reforming the tax code and rebuilding the middle class, we have got to demand that the wealthiest Americans and largest corporations pay their fair share in taxes. Sen. Sanders' tax reform plan accomplishes that goal by closing loopholes that benefit the wealthy and well connected, making the tax code more progressive..." So far, so good, if you believe that America is plagued by insufficiently punitive tax rates. But Sanders's own tax return reveals that his practice doesn't match what he preaches. Specifically, Sanders and his wife claim an income of $205,000, which places them well within the top 5% of American households. He or his apologists may claim that amount doesn't qualify him as "rich," but when a representative sample of 20 Americans is gathered together and you're the richest person among that group, that's a difficult argument to sustain. Delving more deeply, Sanders claimed almost $61,000 in individual deductions. The deductions he chose to claim included home mortgage interest, real estate taxes, state and local income taxes, charitable donations and unreimbursed job expenses such as meals and travel. Here's the problem. As a result of the itemized deductions he chose to claim, the tax rate he paid as a percentage of gross income was 13.5%. According to the Internal Revenue Service, however, the average American filer (with a median income of $65,000, less than one-third of the income Sanders claimed) paid an effective rate of 14.7% of total income. The average taxpayer also claims $7,800 in deductions, compared to $61,000 for Sanders. Some may object at this point that Sanders is perfectly entitled to claim the deductions he claimed, and to pay the tax share that he paid. That is correct. But nothing prevents Sanders from paying the higher tax rate that he claims to support. Neither the IRS or any other authority requires him to claim the deductions he chose to claim, or to pay the applicable tax rate that he otherwise claims is too low. Nor would the federal government return whatever excess amount he chose to pay toward reducing the national debt, subsidizing higher welfare benefits, supporting bonuses for federal employees within its vast bureaucracy or any of the other endless litany of federal programs he ostensibly supports. At a minimum, however, his own behavior dilutes his politician's sanctimony and undermines the credibility that Americans should place in his screeds on inequality in American life. If Sanders is going to lecture us that income inequality "is the great moral issue of our time" and that "ability to pay" should be our guiding principle, it would be nice to see him at least practice what he preaches. |

Related Articles : |