| Federal Regulators Repeatedly Failed to Stop Bernard Madoff - But Now Want Even More Control Over Our Lives? |

|

|

By Timothy H. Lee

Thursday, September 10 2009 |

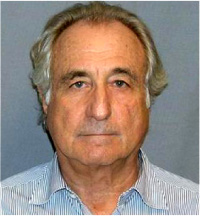

The embarrassing saga of federal regulators’ failure to stop Bernard Madoff’s multibillion-dollar Ponzi scheme despite multiple inquiries and tips provides a very timely lesson. This week, the Securities and Exchange Commission (SEC) released a 477-page report admitting that it overlooked repeated tips and red flags on Mr. Madoff dating all the way back to 1992. At that time, the SEC investigated two Florida accountants who had funneled dollars to Madoff, but curiously chose to prosecute the accountants while taking no action against Mr. Madoff. According to their new report, no fewer than 25 people “relied upon the SEC’s 1992 public statement that there was nothing to indicate fraud” and consequently reinvested directly with Mr. Madoff. This was only one of many examples of bureaucratic incompetence. A May 21, 2003 email from an unnamed hedge fund manager to an SEC investigator explicitly alerted the SEC to “indicia of a Ponzi scheme,” including the facts that Madoff’s accounts were always in cash at the end of each month, replacement capital constantly existed and no other market strategy matched Madoff’s. In other words, the anonymous hedge fund manager all but led the proverbial SEC horse to water. Inexplicably, however, the SEC decided to disregard the allegation. Another anonymous complaint to the SEC warned of a “scandal of major proportion” looming within the Madoff scheme, prompting a call from an SEC investigator to Mr. Madoff’s attorney. When Madoff’s attorney calmly assured the investigator that Madoff didn’t manage the complaining party’s investments, the investigator inexplicably discontinued the inquiry. Other inquiries by the SEC similarly “never found any real problems,” according to the report. Only when Madoff’s sons directly confronted authorities in December 2008 and informed them that their father had confessed to his scheme did government regulators understand what had been right under their noses for years. As we all now know, Madoff was ultimately convicted of orchestrating the largest investor fraud scheme ever committed by an individual, with losses totaling approximately $65 billion. As bureaucrats continue their campaign to suffocate all remaining vestiges of individual freedom in America, this failure by SEC overlords vividly illustrates Big Government’s incompetence and inefficiency despite promises to protect our best interests. Although Barack Obama, Harry Reid, Nancy Pelosi and their chorus never miss an opportunity to mischaracterize Madoff’s fraud as an example of private market failure, they conveniently ignore federal bureaucrats’ failure to stop him, not to mention the fact that everything he did was already illegal. Ignoring this, Congressman Barney Frank and advocates of greater regulation of our lives contend that new governmental powers and bureaucracies are necessary to prevent this from happening again. But didn’t they say the same thing in 2002, when they passed Sarbanes-Oxley? That law, also known as the Public Company Accounting and Investor Protection Act of 2002, came in reaction to the 2000-2001 tech bubble, as well as the accounting scandals emanating from Enron, Adelphia and Tyco, among others. Big-government advocates assured us that it would prevent these sorts of frauds and collapses from happening again, and President Bush labeled it “the most far-reaching reform of American business practices since Franklin D. Roosevelt.” It’s not mere coincidence that we hear the same references to Franklin Roosevelt and the Great Depression today, as Rahm Emanuel’s boss Barack Obama seeks to not let this latest crisis go to waste. In the end, of course, Sarbanes-Oxley failed to prevent the latest round of market bubbles, accounting scandals and fraudulent schemes such as Bernard Madoff’s. It did, however, impose unprecedented levels of bureaucratic red tape, compliance costs, intrusion into private enterprises and drove businesses to relocate from American stock exchanges to foreign markets. Sarbanes-Oxley led to a tripling in the number of American businesses de-registering from public stock exchanges in just the first year, and drastically reduced the number of new listings overall. All the while, the Post Office, Social Security and Medicare now run accounting deficits that would land a CEO in prison if attempted with a private enterprise. It’s all something to consider as Washington seeks to commandeer our healthcare industry, the Internet, energy sector and other vast swaths of our lives before the end of this calendar year. Bureaucratic incompetence isn’t limited to investigations of Ponzi schemes or delivery of the mail. If it is allowed to spread to the healthcare industry, it will ultimately leave its mark on our very lives and health. |

Related Articles : |