| Manchin Flip-Flops on “Build Back Better” Tax Increases |

|

|

By Timothy H. Lee

Thursday, August 04 2022 |

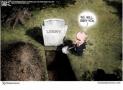

With Americans increasingly desperate for a life preserver, Senator Joe Manchin (D – West Virginia) instead just threw them an anvil forged by Chuck Schumer (D – New York). Although our economy just entered a recession, Manchin inexplicably decided that now’s the perfect time to reverse years of promises by supporting higher taxes and punishing new regulations. Recall that as far back as October 2010, Manchin categorically renounced any willingness to raise taxes during a recession. “I don’t think during a time of recession you mess with any of the taxes or increase any taxes,” he said. Note his emphatic use of the term “any.” Manchin also regularly cites high inflation as a reason to oppose disruptive tax and spending legislation. In an interview last December, for example, he cited inflation four times as a basis for opposing Joe Biden’s “Build Back Better” proposals: I still have these concerns and where I’m at right now, the inflation that I was concerned about, it’s not transitory. It’s real, it’s harming every West Virginian. It’s making it most difficult for them to continue, to go to their jobs, the cost of gasoline, the cost of groceries, the cost of utility bills. All of these things are hitting in every aspect of their life. And you start looking at, then you have the debt that we’re carrying, $29 trillion, you have also the geopolitical unrest that we have… So when you have these things coming at you the way they are right now, I’ve always said, Bret, if I can’t go home and explain it to the people of West Virginia, I can’t vote for it. That was back when inflation stood at 6.8%. Today it stands at 9.1%, which would logically deepen Manchin’s concerns. Additionally, that “geopolitical unrest” that Manchin referenced has only intensified since Russia invaded Ukraine. Inexplicably reversing years of such commitments, however, Manchin just capitulated to a bill increasing taxes an estimated $327 billion. Although an exhaustive list of the bill’s objectionable provisions is impossible, a closer examination reveals details justifying even more outrage. For example, the bill’s increased taxes will fall primarily upon Americans earning under $200,000. That’s according to Congress’s own Joint Committee on Taxation, which found that taxes will increase $17 billion in 2023 for Americans with incomes under $200,000, $14 billion for those earning between $200,000 and $500,000 and $6 billion for incomes between $500,000 and $1 million. So much for Manchin’s, Schumer’s and Biden’s charade of looking out for working Americans. Additionally, as reported by The Wall Street Journal, the legislation’s corporate tax provisions would primarily hit U.S. manufacturers that invest heavily in machines and factories: Manufacturers and other companies making capital investments could pay the bulk of the new corporate minimum tax in Senate Democrats’ fast-moving fiscal legislation, according to an analysis of the plan… [M]uch of the money would likely come from companies that report low tax rates now because their capital investments – in factories and machines, for example – are treated differently in tax and financial accounting. Just as outrageously, the Manchin-Schumer proposal benefits one notoriously malevolent entity – the Internal Revenue Service (IRS). Specifically, the bill directs $80 billion in new funding to increase its army of auditors and attorneys. To put that amount in perspective, the current annual IRS budget is just $13 billion. The Joint Committee on Taxation analysis also found that between 75% to 90% of any dollars extracted by the increased audits would come from Americans earning under $200,000, simply because they’re less capable of hiring their own attorneys to fend off the IRS leviathan. The bill also targets private equity investors and carried interest, which disproportionately benefit small businesses by making them more efficient and competitive in today’s economy. They also undergird the entrepreneurial risk-taking that is the lifeblood of the American economy and growth. Hardly what we need entering a recession. Other provisions introduce electric vehicle subsidies for the wealthy and new bureaucratic drug price controls under the false label “negotiation.” The University of Chicago warns that such a scheme would mean hundreds fewer new lifesaving drugs over the next decade: The United States has fewer restrictions on price than other countries, but the Biden Administration has announced their goal to lower drug prices through greater price regulation… [N]ew drug approvals will fall by 32 to 65 approvals from 2021 to 2029 and 135 to 277 approvals from 2030 to 2039. These significant drops in new drug approvals will lead to delays in needed drug therapies, resulting in worse health outcomes for patients. Accordingly, the Manchin surrender raises taxes, increases regulation, penalizes manufacturers, turbocharges the IRS, undercuts private investors and suffocates pharmaceutical innovators while actually increasing inflation over the near term. Manchin has crafted a false reputation over the years as some sort of honest broker and “regular guy,” but his dangerous capitulation to Schumer should put an end to that charade. Perhaps Senator Kyrsten Sinema (D – Arizona) will do the right thing and spare Americans from the impact of this disastrous bill, and reports indicate that she opposes the destructive carried interest tax provisions referenced above. The question thus becomes whether Sinema will honor her Arizona constituents more faithfully than Manchin did his West Virginia constituents, or simply betray them the way he has. |

Related Articles : |