| Biden’s Own IRS Debunks His Class-Warfare Tax Myths |

|

|

By Timothy H. Lee

Thursday, February 23 2023 |

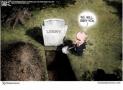

Joe Biden's name has never been synonymous with factual accuracy or intellectual integrity. True to form, his 2023 State of the Union address pitched an exhaustive wish list employing a class-envy predicate that the U.S. income tax system “is not fair”: And we pay for these investments in our future by finally making the wealthiest and biggest corporations begin to pay their fair share. Just begin. Look, I’m a capitalist. I’m a capitalist. But pay your fair share. I think a lot of you at home, a lot of you at home agree with me and many people that you know: The tax system is not fair. It’s not fair… Let’s finish the job and close the loopholes that allow the very wealthy to avoid paying their taxes. You know, there’s a thousand billionaires in America, it’s up from about 600 at the beginning of my term, but no billionaire should be paying a lower tax rate than a school teacher or a firefighter. No, I mean it. Think about it. Ignore for a moment the absurdity of a man who spent his entire career in government insisting upon his capitalist bona fides. Had Biden thought about it as he implored others to do, he would’ve rethought those claims. The latest data from Biden’s own Internal Revenue Service (IRS) shows the shocking degree to which the portion of income taxes paid by wealthier Americans actually dwarfs their corresponding portion of the nation’s income. First, let’s address Biden’s suggestion that wealthier Americans don’t pay their “fair share.” For the 2020 tax year, the latest available, the top 1% (incomes of $548,336 and above) earned 22.2% of the nation’s income. Their share of the nation’s total income taxes paid, however, was 42.3% - nearly twice as high. If paying an income tax share twice as high as one’s income share isn't “fair,” then what might Biden consider fair? Three times their income portion? Four times? One needn’t oppose a progressive income tax to begin asking such questions. Moving on to the top 5% (incomes of $220,521 and above), they earned 38.1% of the nation’s income in 2020. They paid a whopping 62.7% of the nation’s income taxes, however. Accordingly, they’re paying almost two-thirds of all income taxes, yet their share of income remains barely above one-third. Moving up to the top 10% (incomes of $152,321 and above), they earned 49.5% of the nation’s income, so nearly half. Their share of the nation’s income taxes, however, was 73.7% – almost three-fourths. Meanwhile, the top 25% (incomes of $85,853 and above) bracket earned 70.7% of the nation’s income, but paid 88.5% of U.S. income taxes. As for the top 50% (incomes of $42,184 and above), they earned 89.8% of the nation’s income, while paying 97.7% of income taxes. As for the bottom 50% of Americans (incomes under $42,184), they earned 10.2% of total income, while paying one-fifth that share in total income taxes – 2.3%. Accordingly, the share of income taxes paid by Americans in higher income brackets exceeds or even dwarfs the share of income they earned. Second, let’s address Biden’s claim that billionaires pay lower tax rates than school teachers or firefighters. According to the IRS, the top 1% paid an average tax rate of 26.0%, while the top 5% paid an average rate of 22.4%. The top 10% of income earners paid an average rate of 20.3%, and the top 25% paid an average rate of 17.1%. The average rate paid by the top 50% was 14.8%, while the bottom half paid an average rate of just 3.1%. The average rate for all taxpayers was 13.6%. Accordingly, Biden’s claim that billionaires somehow pay lower rates than working class doesn’t match reality. Additionally, it’s important to note that the top 1% paid a higher share of the nation’s income taxes in 2020 than they did in 2017, before taxes were cut under former President Trump. Whether Biden’s misstatements are attributable to dishonesty or ignorance is open to debate. In terms of casting domestic fiscal policy, however, what’s less subject to debate is whether wealthier Americans pay their “fair share.” Biden’s own IRS makes that crystal clear. |

Related Articles : |