|

Bernanke himself announced an injection of roughly $1.5 trillion into the economy last spring. That having failed to move the needle much, he recently announced another $900 billion in 'quantitative easing' would be flooding the market. Someone really ought to inform Dr. Bernanke that, in practice, fighting fire with fire only tends to make the blaze larger.

|

|

| In the land of the blind, the one-eyed man is king. Translation: In a Washington where most decision makers must face the voters on a regular basis, a man with an appointed four-year term can act with impunity unavailable to those who have to answer to the electorate.

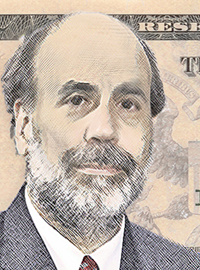

Such is the story of Dr. Ben Bernanke, the Princeton economist turned Federal Reserve Chairman who spent a lifetime studying the Fed’s role in the Great Depression only to head the organization at the historical moment most closely approximating that previous crisis. Had he been Fed chair at virtually any other moment in American history, his name would have been relegated to the margins of history textbooks and the tip of Alex Trebek’s tongue. But such was not his luck. Or ours.

Bernanke’s pedigree as a scholar of the depression has been comforting to those who cling to Santayana’s cliché that those who are ignorant of history are doomed to repeat it. It has been less pacifying for those who remember the dictum of A.H. Maslow: “I suppose it is tempting, if the only tool you have is a hammer, to treat everything as if it were a nail.”

If anything, Bernanke has over-learned the lessons of the Great Depression, when – by his lights – a timid Federal Reserve failed to arrest a deflationary spiral by injecting more currency into the economy. But this misses a key distinction between monetary deflation and demand-driven deflation.

Current concerns about falling prices can’t be blamed on a paucity of currency in the market (the definition of monetary deflation). Bernanke’s predecessor, Alan Greenspan – the fallen angel of Ayn Rand acolytes who blamed the free market system for the financial crisis – leaned on an easy money policy throughout the vast majority of his time as Fed chair. Then Bernanke himself announced an injection of roughly $1.5 trillion into the economy last spring. That having failed to move the needle much, he recently announced another $900 billion in “quantitative easing” would be flooding the market. Someone really ought to inform Dr. Bernanke that, in practice, fighting fire with fire only tends to make the blaze larger.

In the sectors of the economy where prices are currently falling, the phenomenon is a function of decreased demand, not a decreased supply of currency. Housing prices have fallen because a bubble popped and even the bargain homes now available can’t induce a market response sufficient to make up the difference in value. Banks that are flush with capital aren’t lending because (A) they’ve begun to learn the lessons of their spendthrift behavior in the last decade and (B) businesses facing an unsure economic future and a past riddled with debt aren’t exactly clamoring for another round of credit.

The same phenomenon is observable in the broader economy. A recent Moody’s study found American corporations sitting on nearly a trillion dollars in cash reserves. And while the left has been quick to paint this as proof of Wall Street’s heartlessness, does anyone doubt that the nation’s financial mandarins would be putting that money to profitable use if they thought the potential rewards outweighed the potential risks?

While the economic recovery Bernanke hopes to ignite is nowhere to be found, that doesn’t mean that his actions have been without consequence. As former Reagan Treasury official Larry Kudlow wrote earlier this week “Since Bernanke first hinted at quantitative easing in late August, commodity indexes have jumped nearly 20 percent, gold has hit a new record high over $1,400 an ounce, and the dollar has fallen nearly 10 percent against the euro.” And with trillions more dollars floating around the economy, the Fed Chair has placed himself in an inflationary straight-jacket that will only tighten as the money supply expands.

Having devoted a lifetime to studying one of the great economic crises of modern history, Ben Bernanke is flying blind into a new one. He may be the nation’s leading economic general, but he is fighting the last war. |