| IRS and the Spoliation of Evidence Legal Standard |

|

|

By Timothy H. Lee

Thursday, June 26 2014 |

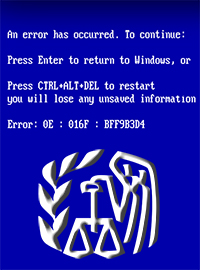

“Innocent until proven guilty” is an unconditional canon within our legal system, right? Not always. As a first-year associate fresh out of law school, my very first assignment centered on the legal issue known as “spoliation of evidence.” Pronouncing the term correctly (spō-lē-Ā-shŭn) took some adjustment, but the concept itself proved fairly straightforward. Stated simply, when accused parties fail to produce relevant evidence within their control, evidence which they are otherwise naturally expected to possess, our legal system allows and even mandates that unfavorable presumptions be drawn against them. So when some item of relevant evidence – whether documents, physical objects or data – relevant to an ongoing legal matter is destroyed, discarded or modified in some way, we presume that the missing evidence was unfavorable to that party and draw conclusions accordingly. In other words, “the dog ate my homework” isn’t a valid excuse under the law when the disappearance is suspicious. Spoliation of evidence is prohibited by an array of laws and regulations, including Title 18 of the United States Code, the Federal Rules of Civil Procedure, state laws and numerous administrative and professional rules. Further, anyone who destroys relevant evidence or assists in such destruction is subject to criminal prosecution, civil fines, tort liability, exclusion of testimony and dismissal of claims, as well as adverse evidentiary inferences as noted above. The underlying rationale for the rule is obvious. Intentional destruction or negligent loss of evidence suggests that the party in possession believed that it was harmful to them, and that consciousness of guilt led them to destroy, hide or lose it. Which brings us to the deepening IRS scandal. Since first accused in 2009 of selectively targeting groups disfavored by the Obama Administration, the IRS has remained under legal obligation to retain all relevant evidence. Throughout that period, however, critical evidence has simply vanished. Even if we accept the excuse that computer malfunction involving several key officials suspected of wrongdoing just coincidentally occurred, the IRS was still under a continuing legal obligation to preserve the hard drives and all other relevant evidence. Instead, it suspiciously destroyed a significant and potentially pivotal portion of that evidence. In multiple hearings this week, the House of Representatives questioned IRS Commissioner John Koskinen about its illegal campaign targeting conservative and libertarian groups, as well as the highly suspicious disappearance of evidence in the matter, including the document trail of Lois Lerner and multiple other IRS officials. To his credit, Rep. Trey Gowdy (R – South Carolina) held Mr. Koskinen’s feet to the fire, including on the issue of spoliation of evidence: Representative Gowdy: You’ve heard the phrase ‘spoliation of evidence,’ haven’t you? Gowdy later added that individual Americans are routinely held accountable by the IRS in such circumstances, so the same standard logically applies in cases against the IRS. And applying that legal standard to the facts of this scandal, the record more than sufficiently suggests spoliation of evidence. If nothing else, Archivist of the United States David Ferriero testified before the same House committee that under federal law, administrative agencies such as the IRS are “required to notify us when they realize they have a problem that could be destruction or disposal, unauthorized disposal” of evidence including Ms. Lerner’s emails. That alone establishes wrongful destruction of evidence by the IRS. Additionally, the IRS was required by law to notify Congress if it learned of lost or destroyed evidence, and the IRS itself required conservative groups seeking tax-exempt status to retain emails and other records for three years. Yet Ms. Lerner’s emails and hard drive began disappearing on June 13, 2011, just 10 days after the IRS received inquiries from House Ways and Means Committee Chairman Dave Camp (R - Michigan). The IRS, however, suspiciously made no recovery effort at that time. Congress had also subpoenaed all relevant evidence in August 2013, and IRS officials were aware of Lerner’s lost emails since at least February of this year, but Koskinen simply failed to mention that during Congressional testimony in March. This week, we learned that Ms. Lerner also sought to audit Senator Charles Grassley (R – Iowa), who sought investigation of IRS targeting of conservative groups. Also this week, the IRS agreed to pay a $50,000 penalty to a conservative group after wrongfully leaking its confidential records. And this is just the tip of the iceberg in terms of evidence suggesting spoliation of evidence. There is certainly no question in the public’s mind. According to one survey, fully 76% of Americans believe the IRS intentionally destroyed evidence. The IRS, Ms. Lerner and Mr. Koskinen are simply not entitled to a presumption of innocence in the court of public opinion, and perhaps later a court of law. |

Related Articles : |