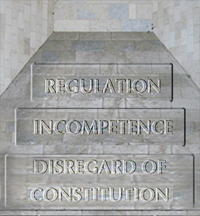

| Sarbanes-Oxley: An Unconstitutional Monument to Governmental Incompetence |

|

|

By Timothy H. Lee

Thursday, December 10 2009 |

Remember when Sarbanes-Oxley was supposed to prevent future market failures? It was July 30, 2002 – not even a decade ago. The world was witnessing a broad and unprecedented economic downturn. Financial panic had descended in the wake of bookkeeping scandals and excessive corporate risk. Such companies as Enron, WorldCom, Adelphia and Tyco became household names. Investors large and small saw untold billions in paper wealth simply disappear. Public confidence and esteem toward Wall Street plummeted to new lows, and we collectively wondered how we all could have been so short-sighted and overexuberant. Sound familiar? In response, righteous politicians, regulators and media pundits confidently stepped forward to save the day. They implored “never again!” They scapegoated “market failure” and “deregulation” (even though the transgressions were already illegal). They demanded burdensome new legislation that would prevent future market collapses. They assured us that only government is large enough and powerful enough fix the problem and prevent it from recurring. The wise and omnipotent shamans in the Senate and House of Representatives directed us toward a mystical path out of our state of fear, and into a brave new world of everlasting comfort, prosperity and security. It’s name? The Senate called it the “Public Company Accounting Reform and Investor Protection Act,” and the House called it the “Corporate and Auditing Accountability and Responsibility Act.” Collectively, it becomes popularly known as “Sarbanes-Oxley,” “Sarb-Ox” or simply “SOX.” The final Sarb-Ox bill contained no fewer than eleven broad title sections, and created a new federal bureaucracy called the Public Company Accounting Oversight Board (PCAOB) to mandate and oversee accounting audits of public companies. It also imposed an endless array of taxes and new regulations, disclosure requirements, outside audit guidelines, corporate governance dictates, criminal penalties, internal controls and conflict-of-interest rules. Sarb-Ox was supposed to stand as a shining monument of bipartisan federal benevolence, and usher in a new era of financial stability and trust. Well, that didn’t last very long. Merely six years later, what wasn’t supposed to happen again… happened again. And like clockwork, the same politicians, pundits and power-seeking regulators blamed “deregulation” even though the financial industry that triggered the downturn was one of the most regulated – not deregulated – sectors of our economy. While the Securities and Exchange Commission (SEC) predicted in 2003 that Sarb-Ox would cost the average company only $91,000 per year, a 2008 SEC analysis concluded that compliance costs total $2.3 million for the average company. Sarb-Ox has also stifled initial public offerings in America, as an SEC survey reveals that 70% of small businesses and 44% of all public companies said that it has inclined them toward going private rather than public. The survey also reveals that over 51% of responding companies state that Sarb-Ox has inclined them toward de-listing in the United States. And more fundamentally, 74% of those responding to the survey confirmed that it has had “little or no impact” upon market confidence. In addition to failing at its intended purpose, however, Sarb-Ox also suffers from the drawback of being unconstitutional. This is because the proponents of Sarb-Ox, in their legislative haste, ignored Article II, Section 2 of the Constitution, which grants exclusive power to the President to appoint officers of the United States. In defiance of that provision, Sarb-Ox collectively empowers the SEC to appoint PCAOB members, who in turn possess the power to regulate corporate auditors and companies. While this may sound trivial or technical, the appointment power was actually a critical concept in the minds of our Founding Fathers when they drafted the Constitution. As noted by Sam Kazman, who serves as General Counsel at the Competitive Enterprise Institute (one of the plaintiffs in the Supreme Court case against Sarb-Ox), the framers had witnessed the oppressive power of England’s royal bureaucracies, and referred in the Declaration of Independence to the “multitude of new offices” and “swarms of officers to harass our people and eat out their substance.” Accordingly, the Founding Fathers insisted upon greater bureaucratic accountability in establishing our system of checks and balances. Thus, Sarb-Ox is not only counterproductive, but unconstitutional. Seven years following its enactment, Sarb-Ox now stands as a monument to regulatory futility, costly government incompetence and disregard of the Constitution’s checks and balances. It thus provides a timely lesson as the White House and Congress shower us with endless new iterations of Sarbanes-Oxley. Let us therefore learn from recent history, rather than allow Barack Obama, Harry Reid, Nancy Pelosi and Barney Frank to repeat it. |

Related Articles : |