| Living Social(ist): Alerting America to Dumb Government Policies |

|

|

By CFIF Staff

Thursday, September 02 2010 |

|

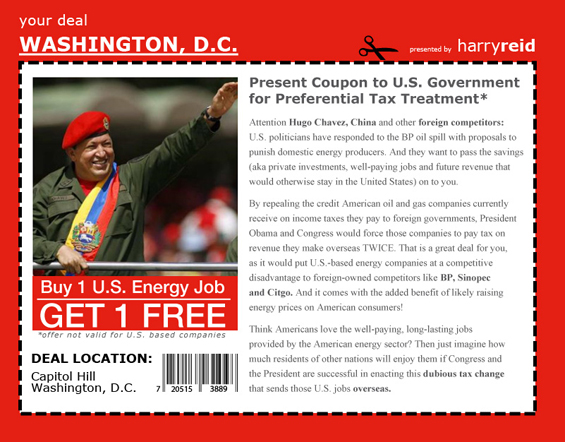

Act Now: Congress and Obama Want Preferential Tax Treatment for Foreign-Owned Energy Producers CFIF has released a Living Social(ist): Bad Deal Alert, a new take on the trendy deal-of-the-day email coupon services exploding in popularity across the country. Instead of offering half-priced chocolate spa baths or $1 admissions to your local petting zoo, we highlight a truly foolish idea currently being considered by President Obama and Congress. This particular "coupon" – which is being offered to foreign, mostly state-owned energy producers like Hugo Chavez’s Citgo – calls attention to a dubious new tax hike in the president’s proposed 2011 budget. It’s a great deal for foreign competitors as it would double-tax domestic oil and gas producers on money earned overseas, leaving foreign-owned companies with a competitive advantage in the marketplace. Plus, it comes with the added benefit of limiting America’s access to energy resources that fuel our economy, provide 9 million domestic jobs and ensure our access to affordable energy.

We hope this humorous take on a serious issue will inspire readers to join CFIF in opposing this job-killing proposal. Remember, by doing away with the credit for dual capacity taxes for America’s oil and gas industry, Congress and the president would effectively be handing jobs, revenue and investment to foreign and mostly state-owned oil companies in Venezuela, China and the Middle East. And it would reduce America’s energy independence and security, while raising energy prices for American families. And, please help us spread the word by sharing this with your friends, colleagues and family members. |

Related Articles : |