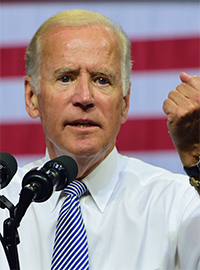

| Hey, Joe: It’s Still the Economy, Stupid, not “Junk Fees” |

|

|

By Timothy H. Lee

Thursday, May 02 2024 |

If the adage “rearranging deck chairs on the Titanic” occasionally feels shopworn, it nevertheless accurately captures Biden administration efforts to soothe rising discontent among Americans whose economic pain is attributable to Biden’s own policy mismanagement. With Biden’s reelection prospects sinking lower despite media efforts to bubble wrap him, that widespread discontent remains a leading reason. Economic growth is grinding toward a halt while inflation just doubled from the previous quarter despite premature Biden claims of “mission accomplished.” In fact, inflation hasn’t declined since June 2023. Elsewhere, mortgage rates are back above 7% and home ownership is now costlier than ever. Credit card debt and auto loan delinquencies are rising to alarming levels, and office loan defaults have already returned to 2008-09 financial crisis levels. Consumer sentiment also just sank to levels last seen during the peak inflation days of summer 2022. Meanwhile, Biden’s deficits have resumed their rise toward the $2 trillion mark while the national debt is at record levels and far exceeds the size of the U.S. economy. Rather than confront and correct those negative economic trends, however, the Biden administration just wants to play small ball. Specifically, in recent months the administration has ostentatiously vowed to eliminate so-called “junk fees” from the economy and promised to somehow save Americans billions of dollars. That fig leaf transparently reflects a Biden administration desperate to find some sort of political cover for its mismanagement of our nation’s economy. What the administration obviously fails to acknowledge is that inflation, brought about in large part by out-of-control government spending, continues to make life difficult for small businesses and working Americans struggling to absorb punishing day-to-day costs. With economic growth slowing, overall costs for consumer goods up approximately 20% and gas prices up 62% since Biden entered office in January 2021, Americans simply can’t afford political antics of this sort. Instead, what they need from Biden is greater wisdom and political leadership to correct course on economic policies that matter most. Focusing on back-end fees, in contrast, will actually only have the effect of leading to higher consumer prices and reducing free market competition while limiting services on which Americans rely. The Biden administration should focus on real reasons why American families struggle with the high cost of living and address more serious threats to our nation’s economy. On a superficial level, moreover, so-called “junk fees” can seem frustrating, but upon closer examination they’re essential to many businesses. For example, the “hidden fee” getting the most attention from the Biden Administration, credit card late fees, have now been capped at $8. At first glance, reducing those delinquent fees might seem beneficial to consumers, but placing limits on them will only force credit card companies to tighten their lending standards, reduce credit limits, cut back on credit rewards and increase interest rates. Those changes would significantly punish many low-income Americans who already struggle to stay afloat, and who could find themselves denied credit and loans as a direct result of the Biden administration’s policy. Accordingly, eliminating delinquency fees will only lead to more struggles for consumers and businesses. American consumers would be better served if President Biden instead prioritized policies that promote economic growth and support middle- and lower-class consumers by reducing regulations that raise consumer costs and stifle innovation. In contrast, the Biden administration narrative about so-called junk fees is a flimsy political ploy to distract Americans from high inflation and accelerating economic headwinds that punish working Americans most of all. The administration would rather divert Americans’ attention by attacking banks, credit card companies and businesses providing essential service to families across our country. Don’t let the administration’s bait and switch tactics divert the conversation and ignore the true problems plaguing our economy. |

Related Articles : |