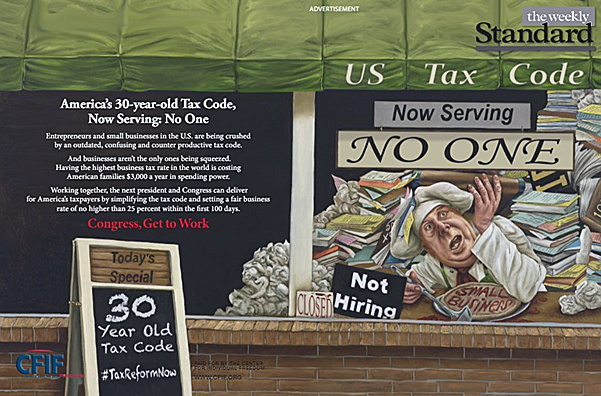

| CFIF Ad: America’s 30-year-old Tax Code, Now Serving No One |

|

| Thursday, July 14 2016 |

|

With our two major parties holding conventions this month and setting agendas for the next four years, now is the perfect time for Americans of all political persuasions to come together and urge comprehensive tax reform. Reforming our outdated tax code is a rare policy that maintains significant bipartisan support. Regardless of political affiliation, nearly all agree on one thing – Congress and the future President must enact comprehensive reform as soon as possible. The Center for Individual Freedom has commissioned a cartoon depicting how badly the current code crushes businesses of all sizes. It highlights the fact that our code is nearly 30 years old, and how confusing and bloated it has become over these years. American small business owners, like the pizza shop owner in the cartoon, often feel as though they are drowning in paperwork and that the code limits their opportunities. We should not have to contend with a code that places such a large burden on American businesses. Instead, we need a system that simplifies the entire process, lowers the rate across the board for businesses of all sizes and encourages the growth and opportunity for entrepreneurs and business owners. In today's world our companies must compete against companies around the globe, and they simply cannot continue to succeed with our current counterproductive code. Other countries around the world have continued to reduce their tax rates, while the United States maintains the world’s highest corporate tax rate. That creates an environment where some of the strongest American corporations have been forced to leave in favor of lower rates abroad. Corporate inversions, like those performed by Burger King, Johnson Controls, and Medtronic, are all too common and demonstrate the serious problems with our current code. Sadly, America's excessively high corporate tax rate negatively affect all Americans. Specifically, they cost American families an estimated $3,000 every year in spending power. Think about the good that extra $3,000 could accomplish both for families and the US economy generally. With that increasingly troubling reality in mind, the United States should develop a code that encourages more companies to come here to do business instead of leave. Lowering the business rate to no more than 25 percent for all companies would be an important first step in accomplishing that. The world has rapidly changed over the past 30 years and it is time for a modernized tax code that reflects this. We now face competition from every corner of the globe and we need a tax system that allows us to stay competitive. Regardless of the outcome of the 2016 election, our Representatives and the President must enact meaningful tax reform. The US should be seen as business friendly – this will only happen if we reform our code as soon as possible. Look out for our cartoon, “America’s 30-year-old Tax Code, Now Serving: No One,” in the Weekly Standard and The Washington Examiner. Copies will be distributed at both conventions in Cleveland and Philadelphia, and on Capitol Hill. |

Related Articles : |