This Week’s “Your Turn” Radio Show Lineup

Listen live on the Internet here. Call in to share your comments or ask questions of today’s guests at (850) 623-1330.

Are wealthier Americans paying their “fair share” of taxes?

No. Assuming that one measures “fair share” as a rough equivalency between income earned and income taxes paid, wealthy Americans pay far more than their fair share, as helpfully illustrated by the Tax Foundation:

.

"Fair Share?"

.

An instructive myth-versus-fact visual when it comes to public assumptions regarding corporate profits, courtesy of AEI:

.

Myth Versus Fact: Corporate Profits

.

Since World War II, the U.S. economy has averaged 3.3% growth per year. Under Barack Obama, we never even hit 3%, instead averaging below 2%. His apologists rationalized that “secular stagnation” had made 3% an unattainable goal, but both quarters under President Trump have already averaged over 3%. So like clockwork, leftists attempt to credit Obama for something they claimed was no longer possible:

.

.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

In last week’s Liberty Update, we highlighted how when even The New York Times acknowledges how Trump Administration policies have turbocharged the sluggish economy he inherited, the debate over whether the economy benefits from more federal regulation or less federal regulation is won. This is the same Times that features far-left economist Paul Krugman, who predicted upon Trump’s election that markets would crash and “never” recover.

Well, we’re happy to highlight how the slow surrender march at the Times continues under the headline “Companies Are Handing Out Bonuses Thanks to the Tax Law. Is It a Publicity Stunt?” Their snarky addendum is understandable coming from them, but their introduction acknowledges reality:

.

The big corporate tax break that became law last month is great news for companies and their investors. But what about employees? How much of the corporate windfall will go to workers via higher wages?

Since President Trump signed the $1.5 trillion tax cut into law on Dec. 22, nearly 20 large companies have announced some form of bonus or wage hike for their employees.”

.

It proceeds to list some of those companies, including AT&T, Comcast, Southwest Airlines, American Airlines and others.

In last week’s Liberty Update feature we noted how their January 1 story admitted that the good economic news it detailed occurred before the tax reform legislation had even passed. Now that it has, we’re glad to see that the Times at least continues its sudden trend of acknowledging reality.

Today’s guest lineup includes:

4:00 CDT/5:00 pm EDT: Marc Scribner, Senior Fellow at the Competitive Enterprise Institute: Infrastructure Spending and Drones;

4:15 CDT/5:15 pm EDT: Dr. Susan MacManus, Professor in Political Science at the University of South Florida: 2018 Legislative Session and Business Incentives;

4:30 CDT/5:30 pm EDT: Tzvi Kahn, Senior Iran Analyst at the Foundation for Defense of Democracies: Iran;

4:45 CDT/5:45 pm EDT: Pete Sepp, President of National Taxpayers Union: The Days Following Tax Reform;

5:00 CDT/6:00 pm EDT: Michelle Minton, Senior Fellow at the Competitive Enterprise Institute: Trump Marijuana Policy;

5:15 CDT/6:15 pm EDT: Jarrett Stepman, Editor for the Daily Signal at The Heritage Foundation: Fake News; and

5:30 CDT/6:30 pm EDT: Raheel Raza, President of the Council for Muslims Facing Tomorrow and Clarion Project Advisory Board Member: Trump’s Decision on Jerusalem.

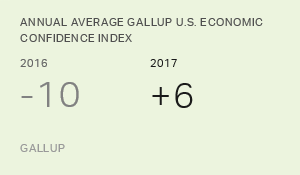

In our weekly Liberty Update, we highlight how in just one year, the deregulatory Trump economic bump is now so inescapable that even The New York Times acknowledged it in its January 1, 2018 edition. Given that consumer spending accounts for approximately two-thirds of the U.S. economy, Gallup’s annual average U.S. economic confidence index is similarly illustrative. For 2016, despite years of supposed prosperity under Barack Obama, the index stagnated at -10. In just one year since Trump’s deregulatory and lower-tax administration began? Already +6 for the year, the first time in over a decade:

.

Instant Trump Bump

.