Many claim to prefer bipartisanship out of leaders in Washington, D.C., and right now we’re witnessing an encouraging example of it.

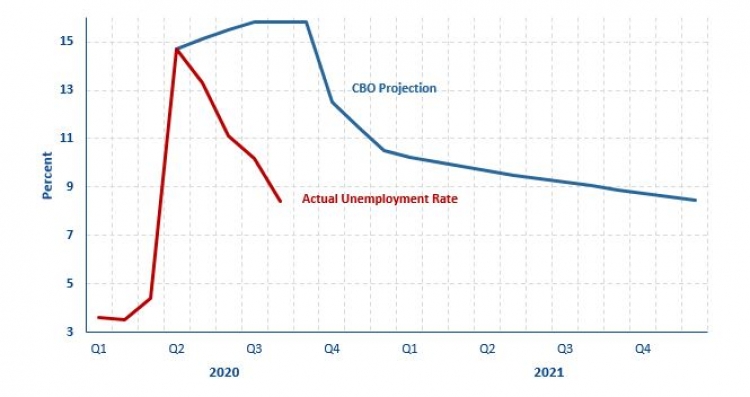

Specifically, Senators Mike Braun (R – Indiana), Joe Manchin (D – West Virginia), Angus King (I – Maine), James Lankford (R – Oklahoma), Kyrsten Sinema (D – Arizona), and Susan Collins (R – Maine) have written National Labor Relations Board (NLRB) Chairman Lauren McFerran seeking reconsideration of the NLRB’s proposed “Joint Employer Rule” that they correctly warn “would have negative effects on workers and businesses during a time that many are already struggling following the COVID-19 pandemic.”

For years we at CFIF have sounded the alarm on the Joint Employer Rule that the Senators target, because it would dangerously reverse decades of established labor law by holding businesses liable and responsible for employees of franchisees whom they didn’t hire and over whom they exercise no control:

Under longstanding court precedent and National Labor Relations Board (NLRB) interpretation, an ’employer’ for purposes of applying the nation’s labor laws was generally defined to include only those businesses that determined the essential terms and conditions of employment.

As a textbook illustration, imagine a franchise arrangement whereby the franchisee determines whom to hire, whom to fire, wages and other everyday working conditions. The distant franchisor, in contrast, obviously doesn’t fly every potential franchisee employee in for an interview at corporate headquarters or micromanage its franchisees’ working conditions.

On that logic, the Third Circuit Court of Appeals ruled in NLRB v. Browning-Ferris Industries (1982) that the appropriate standard for defining an employer with regard to a particular set of employees was established by the U.S. Supreme Court in Boire v. Greyhound Corp. (1964). It held that only businesses exercising control over ‘those matters governing the essential terms and conditions of employment’ were subject to collective bargaining requirements and liabilities.

Two years later, the NLRB formally adopted that standard, ruling in separate cases that ‘there must be a showing that the employer meaningfully affects matters relating to the employment such as hiring, firing, discipline, supervision and direction.’ In other words, an ’employer’ for purposes of labor law mandates required direct and immediate control over the terms and conditions of employment.

That stands to reason, since it makes no sense to impose legal liability upon employers that don’t actually control a bargaining unit’s employment conditions.

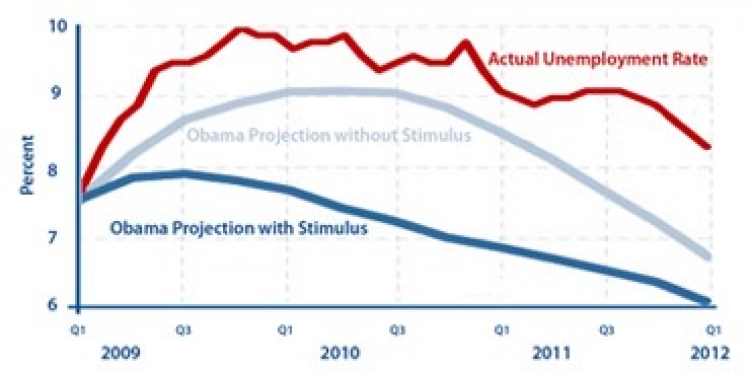

In August 2015, however, Obama’s NLRB suddenly and needlessly upended that established legal standard by redefining what’s known as the ‘Joint Employer Doctrine.’ Essentially, the Joint Employer Doctrine now allows multiple businesses to be held legally liable for the same set of employees.

Thus, in the infinite wisdom of the Obama NLRB, even employers with indirect or even merely potential ability to affect employment terms could suddenly find themselves subject to federal labor laws.”

In their letter, the Senators highlight the potential harm of the proposed rule. They note that in the United States, nearly 775,000 franchises employ 8.2 million workers and provide $800 billion of economic output, which is projected to grow in 2022 to nearly 800,000 franchises. As they further note, the International Franchise Association (IFA) found that the proposed rule could “cost franchise businesses $33.3 billion per year, resulting in 376,000 lost job opportunities, and led to a 93% increase in lawsuits.”

These Senators demonstrate welcome bipartisan leadership, and Americans should contact their Senators to make their support clear.

CFIF Freedom Line Blog RSS Feed

CFIF Freedom Line Blog RSS Feed CFIF on Twitter

CFIF on Twitter CFIF on YouTube

CFIF on YouTube