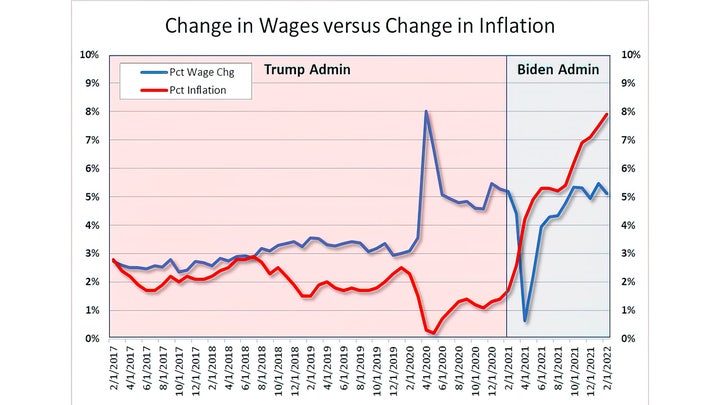

As inflation continues to spiral upward at multi-decade highs and with the U.S. economy now in recession, maintaining an “all of the above” array of lending options for American consumers becomes more and more important. Unfortunately, activist groups like the “National Consumer Law Center” aim to do the opposite and limit rather than expand consumer options.

For a sense of consumers’ growing desperation, consider a Federal Reserve report on exploding credit card debt, as highlighted by Steve Cortes:

How have consumers dealt with these skyrocketing prices? The simple answer, unfortunately: via credit cards, particularly for working-class households. Just last week, the Federal Reserve Bank of New York issued a damning report on this credit binge for consumers, into a pronounced economic slowdown.

Total consumer debt rose a staggering $40 billion in June, far surpassing Wall Street expectations of a $25 billion increase…

A huge portion of this new debt flows from costly, risky credit card use. In fact, for the April-June second quarter of 2022, total credit card debt rose a staggering $46 billion, the biggest jump in 20 years. Americans pile into new accounts to accomplish this borrowing, opening up a whopping 233 million new cards during that second quarter, the most new cards since 2008. Such comparisons to the Great Recession should worry everyone.”

Additionally, credit cards aren’t always a viable option for many Americans, and traditional bank loans aren’t always an option due to small amounts needed for short-term emergencies. Whereas higher-income Americans with stronger credit history can borrow from banks, utilize assets they possess as leverage or use their savings, consumers with lower credit scores or lacking sufficient savings cannot. Indeed, according to the Fair Isaac Corporation, some 46% of consumers possess credit scores below 700, meaning that traditional bank loans aren’t possible for them.

In such circumstances, struggling Americans can access the money they need for the short-term via consumer finance loans.

Groups like the National Consumer Law Center (NCLC), however, want to limit the availability of such options, which they falsely characterize as some sort of scheme “to snare consumers into predatory loans for auto repairs, tires, furniture, and even pets.”

In reality, however, the unintended consequence of efforts like that of the NCLC will be to drive temporarily strapped consumers to seek out illegal loansharks, suffer overdrafts, or simply be unable to cover their temporary costs. As none other than the World Bank found, such limitations lead to “increases in non-interest fees and commissions; reduced price transparency; lower number of institutions and reduced branch density; and adverse impacts on bank profitability, in addition to the lack of access for smaller and riskier borrowers.”

That doesn’t help the people whom groups like the NCLC claim to protect, it hurts them. Accordingly, American consumers and elected leaders should recognize the peril that NCLC and similar groups present. Their efforts would only make consumer lending more difficult, more dangerous and more expensive.

CFIF Freedom Line Blog RSS Feed

CFIF Freedom Line Blog RSS Feed CFIF on Twitter

CFIF on Twitter CFIF on YouTube

CFIF on YouTube