Greetings From Puerto Rico… the Welfare State

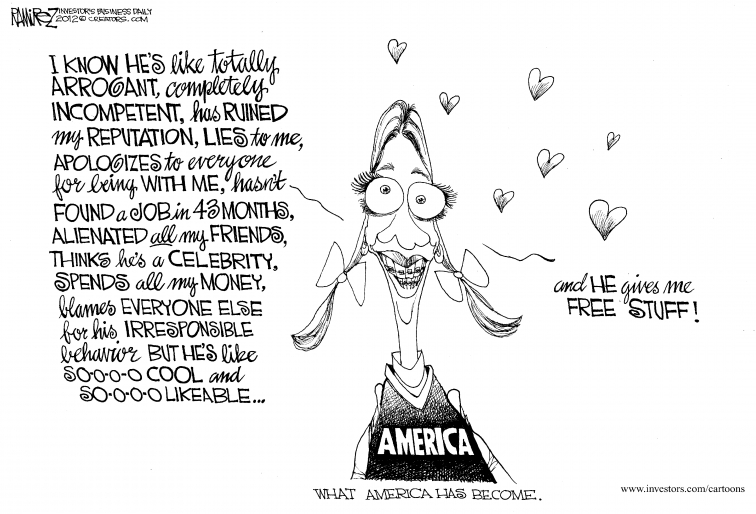

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

The American Enterprise Institute’s Kevin Hassett and Aparna Mathur have an important (and devastating) piece in today’s Wall Street Journal breaking down the misleading facets of the left’s argument that the U.S. is currently suffering through a crisis of economic inequality. Here’s a particularly eye-opening excerpt:

In the first place, studies that measure income inequality largely focus on pretax incomes while ignoring the transfer payments and spending from unemployment insurance, food stamps, Medicaid and other safety-net programs. Politicians who rest their demands for more redistribution on studies of income inequality but leave out the existing safety net are putting their thumb on the scale.

Second and more important, it is well known that people’s earnings in general rise over their working lifetime. And so, for example, a person who decides to invest more in education may experience a lengthy period of low income while studying, followed by significantly higher income later on. Snapshot measures of income inequality can be misleading.

Thomas Sowell frequently makes a point complimentary to Hassett and Mathur’s second observation above: that measuring income inequality over time tends to be deeply misleading because membership in any given income bracket is highly fluid, with people’s income often shifting dramatically over time. Thus, someone who’s in the bottom quintile of income in today’s measurements may be in the second quintile from the top in 15 years’ time. But we tend to analyze these groups as if their composition is static.

Hassett and Mathur’s first point, however, is the one that always bowls me over. If the point of a safety net is to remove people from the perils of indigence, yet the government refuses to factor those provisions into measurements of income, we end up with a perpetually imperiled underclass that only exists on paper. As Mark Twain said (supposedly quoting Disraeli), there are three kinds of lies: “Lies, damned lies, and statistics.”

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

In an interview with CFIF, National Review deputy managing editor Kevin Williamson discusses his new book, The Dependency Agenda, and the plot by Democrats to earn votes by making more Americans more dependent on the government.

In an interview with CFIF, National Review deputy managing editor Kevin Williamson discusses his new book, The Dependency Agenda, and the plot by Democrats to earn votes by making more Americans more dependent on the government.

Listen to the interview here.

Pity our poor friends in Europe. They just can’t seem to stomach the lesson that the faltering state of the continental monetary union has made all but impossible to ignore. Rather than making a clean break from the common currency, it now appears that the smart set wants to double down. This item, appearing earlier this week in the Wall Street Journal, is nothing short of chilling in its implications:

Germany is sending strong signals that it would eventually be willing to lift its objections to ideas such as common euro-zone bonds or mutual support for European banks if other European governments were to agree to transfer further powers to Europe.

If embraced, the move would deepen in fundamental ways Europe’s political and fiscal union and represent one of the boldest steps taken by the bloc since the euro was launched. Germany has never before been willing to discuss the conditions it believes necessary to move toward assuming common risks within the euro zone. Now, although the end may be a long way off, it appears willing to discuss those conditions.

“The more that other member states get involved with this development and are prepared to give up sovereign rights to get European institutions more involved, the more we will be prepared to play an active role in developing things like a banking union,” a German official familiar with the discussions told The Wall Street Journal. “You can’t have one without the other.”

Translation: the Europeans are seriously considering throwing the car in reverse and seeing just how far they can push the speedometer. It’s true that an economic union without a matching political consolidation was always doomed to fail (the practical effect has been Southern Europe living off the North), but the move towards a true United States of Europe brings to mind James Madison’s observation from Federalist #10 about destroying liberty in order to cure the problem of political faction: the cure is worse than the disease.

A continent-wide government will destroy all pretense of national sovereignty throughout Europe, leaving the bureaucrats of Brussels to steer a bold new course that will vanquish the national character of some of the world’s proudest nations, perpetuate a failing economic model, and cede previously democratic powers to unelected technocrats.

Let us pray that Europe doesn’t go down this road. If it does, the burden of Western leadership will fall even more disproportionately on American shoulders than it does already.

It’s almost hackneyed at this point to evoke Greece as a warning sign to the rest of the Western World; as a promise of what’s in store should the artificial decadence of the welfare state completely strangle individual initiative in developed nations. Yet there’s a reason that California on the Aegean is always the cautionary tale of choice: when it comes to outright political absurdity, the birthplace of democracy is constantly outdoing itself. The most recent example — which has to be read to believed — comes courtesy of James Angelos reporting in the Wall Street Journal:

Greece’s radical left party has upended the country’s politics with an idea as simple as it is seductive: Athens can renege on the deals it made in exchange for a bailout, and still remain in the euro.

Greece’s future, and possibly that of Europe’s monetary union, may depend on how many Greeks buy into the idea.

The Coalition of the Radical Left, known as Syriza, is competing with Greece’s conservative New Democracy to become the biggest party in Parliament in June 17 elections that could send further shock waves through Europe …

Syriza leader Alexis Tsipras, a 37-year-old former Communist youth activist, promises that despite its dire financial straits, Greece can halt austerity programs, restore social spending and nevertheless continue to receive the payments from the euro zone and the International Monetary Fund that keep it from bankruptcy.

The repeated warnings to the contrary from Europe and the IMF are simply efforts to blackmail Greece into doing what they want it to do, Mr. Tsipras says.

A few facts about Greece to consider in light of Mr. Tsipras’s demagoguery. This is a nation where public employees have no compunction about taking monthly paychecks 14 times a year (yes, you read that right: 14) and where tax evasion is so widespread that it’s estimated that 30 percent of the national economy is in the black market. And now the proposed solution from one of the nation’s two major political parties is to welch on a deal with the rest of the continent?

Greece is experiencing an economic crisis, to be certain. But it looks increasingly like that is only a symptom of a deeper moral crisis.

The Heritage Foundation is out today with its 2012 Index of Dependence on Government, and the results aren’t pretty. The study finds that Americans are more in thrall to the state than ever before. Amongst the report’s findings:

- One in five Americans—the highest in the nation’s history—relies on the federal government for everything from housing, health care, and food stamps to college tuition and retirement assistance. That’s more than 67.3 million Americans who receive subsidies from Washington.

- Government dependency jumped 8.1 percent in the past year, with the most assistance going toward housing, health and welfare, and retirement.

- The federal government spent more taxpayer dollars than ever before in 2011 to subsidize Americans. The average individual who relies on Washington could receive benefits valued at $32,748, more than the nation’s average disposable personal income ($32,446).

- At the same time, nearly half of the U.S. population (49.5 percent) does not pay any federal income taxes.

There are three tragedies at work here. The first is that the federal government — through relentless taxation, regulation, and legislation — has kept the economy in such miserable condition as to necessitate so many people looking for assistance. The second is that so many sectors that enjoy public subsidies — such as higher education and health care — are actually made more expensive by the federal largesse. And the third is the broader social trend of Americans coming unmoored from the independent, self-made spirit of our forebears, content instead to live in a gilded cage to which Washington holds the key.

Changing that mindset will be just as important as changing public policy if the American people are to rediscover their trademark sense of rugged individualism.

One does not have to be a particularly astute connector of socio-political dots to watch the recent rioting that has gripped London and find parallels to America’s enfeebled welfare state. That makes the following bravura passage from Theodore Dalrymple at City Journal all the more disquieting:

The riots are the apotheosis of the welfare state and popular culture in their British form. A population thinks (because it has often been told so by intellectuals and the political class) that it is entitled to a high standard of consumption, irrespective of its personal efforts; and therefore it regards the fact that it does not receive that high standard, by comparison with the rest of society, as a sign of injustice. It believes itself deprived (because it has often been told so by intellectuals and the political class), even though each member of it has received an education costing $80,000, toward which neither he nor—quite likely—any member of his family has made much of a contribution; indeed, he may well have lived his entire life at others’ expense, such that every mouthful of food he has ever eaten, every shirt he has ever worn, every television he has ever watched, has been provided by others. Even if he were to recognize this, he would not be grateful, for dependency does not promote gratitude. On the contrary, he would simply feel that the subventions were not sufficient to allow him to live as he would have liked.

A challenge for readers: remove the first sentence from the above passage. Then see if you can find anything that doesn’t apply to modern-day America. It could happen here.

… can be found in the pages of today’s USA Today. Behold four of the clearest, most incontrovertible, and most horrifying paragraphs you’ll ever read in print:

Paychecks from private business shrank to their smallest share of personal income in U.S. history during the first quarter of this year, a USA TODAY analysis of government data finds.

At the same time, government-provided benefits — from Social Security, unemployment insurance, food stamps and other programs — rose to a record high during the first three months of 2010.

Those records reflect a long-term trend accelerated by the recession and the federal stimulus program to counteract the downturn. The result is a major shift in the source of personal income from private wages to government programs.

The trend is not sustainable, says University of Michigan economist Donald Grimes. Reason: The federal government depends on private wages to generate income taxes to pay for its ever-more-expensive programs. Government-generated income is taxed at lower rates or not at all, he says. “This is really important,” Grimes says.

Let’s review: you cannot have a welfare state without a private sector vibrant enough to fund it. You cannot have a private sector vibrant enough to fund it unless government allows the market to function relatively unimpeded. And the market can’t function relatively unimpeded unless the welfare state stays modest in scope. What exactly don’t the folks in Washington, Sacramento, and Athens understand?

The Wall Street Journal offers some penetrating analysis on the inevitably inverse relationship between government financing of “guns” and “butter.” When tax receipts dwindle, appropriators often choose between funding social welfare programs (butter) and national defense (guns). Unsurprisingly, the European welfare state provides a cautionary example.

The overlooked culprit here is the rise of the modern welfare state. Since World War II and especially from the 1960s, Europe has built elaborate domestic income-maintenance programs, with government-run health care, pensions and jobless benefits. These are hugely expensive, requiring high taxes and government spending that is a huge proportion of GDP.

The Europeans’ obsession with income stabilization through higher taxes means there is less economic growth and less money to spend. These continental priorities mirror the massive increases in social spending enacted or proposed under President Obama – economic stimulus, health care “reform,” cap-and-trade and job creation.

As the U.S. federal deficit balloons, politicians and bureaucrats will look for ways to balance the books. And given the current Administration’s and Congress’ love affair with “butter,” unfortunately, they’ll likely look to slash spending on national defense while our nation is at war.