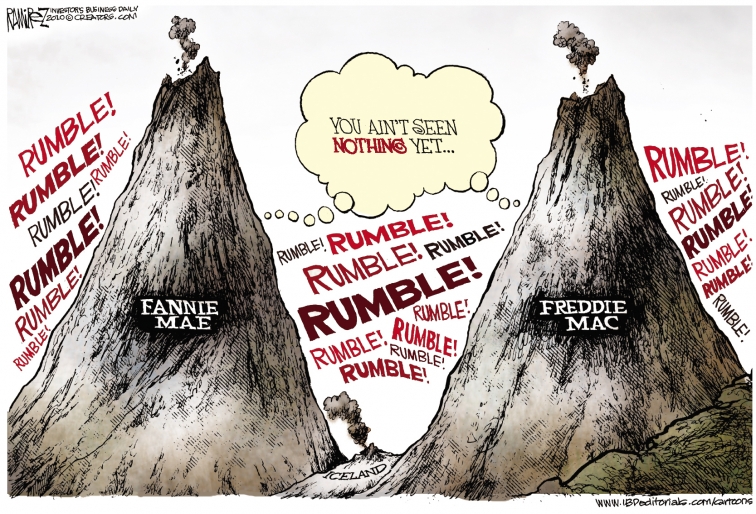

As Goldman Sachs is reeled into court for potential securities fraud, a bigger fish is still swimming free and wreaking havoc on the public. Freddie Mac, one half of the not-so-dynamic duo of government-backed mortgage peddlers, took another massive hit during the first quarter of the year. The company, which is largely owned by the federal government after the 2008 bailouts, is set to ask for an additional $10.6 billion in “federal aid,” aka more bailouts.

With assistance and pressure from Washington to make housing affordable for all, one can see how Freddie Mac thinks that money grows on trees. Unfortunately, all of us in the real world, from whom the government is funded, should be concerned how “We the Taxpayers” are going to come up with another $10 billion to flush down the toilet. Not to mention why.

More troubling, while Goldman Sachs is getting grilled at congressional hearings, financial reform legislation, which unleashes a broadside against banks, but not a single provision addressing the troublesome Fannie and Freddie, will soon be ushered to a vote. The Kansas City Star’s E. Thomas McClanahan stated it well:

“Wall Street’s excesses sent the markets and the economy off a cliff, but the seeds of the debacle were planted by politicians and richly fertilized by their creations: Fannie and Freddie…”

The shenanigans on Wall Street may or may not have brushed up against the law, but the opportunity and incentive would not have existed had the federal government and its lending arms, Fannie and Freddie, not insisted on giving mortgages to folks who could not afford them. Congress should remember as they point a finger at Wall Street that four fingers are pointing back at them.

Logan Beirne, Lecturer in Law and Fellow at Yale Law Schools, discusses the Treasury Department’s seizure of Fannie Mae’s and Freddie Mac’s net profits and why the “Net Worth Sweep” violates the rule of law.

Logan Beirne, Lecturer in Law and Fellow at Yale Law Schools, discusses the Treasury Department’s seizure of Fannie Mae’s and Freddie Mac’s net profits and why the “Net Worth Sweep” violates the rule of law.

CFIF Freedom Line Blog RSS Feed

CFIF Freedom Line Blog RSS Feed CFIF on Twitter

CFIF on Twitter CFIF on YouTube

CFIF on YouTube