When pondering the origins of American Exceptionalism, and what makes us the most innovative, prosperous nation in human history, look first to our tradition of protecting intellectual property (IP) – patent, copyright, trademark, and trade secret property rights.

After all, other nations match or even exceed the U.S. in free market rankings (24 nations in the latest annual Index of Economic Freedom, in fact). No nation, however, can match us for sheer innovation. America accounts for less than 5% of the world’s population, and even with the world’s largest economy we account for under 25% of the global economy. In contrast, no nation can match our scientific innovation, from flight to space exploration to the internet. Nor can any nation match our artistic leadership, from the film industry to television to music, or claim as many instantly recognizable trademarks, from Coca-Cola to Apple.

Year after year, that’s why the U.S. leads global rankings of IP protection.

Perhaps most conspicuously, the U.S. accounts for fully two-thirds of all new lifesaving pharmaceuticals introduced to the world each year. In an era increasingly reliant on pharmaceutical treatments for everything from Covid to cancer to Alzheimer’s, that is a leadership of which we should remain both proud and protective.

Inexplicably, however, some voices seek to undermine that IP leadership position. A group called I-MAK offers the latest assault, with a “study” entitled “Overpatented, Overpriced,” which attempts to show “how excessive pharmaceutical patenting is extending monopolies and driving up drug prices.” We employ scare quotes around the term “study” because I-MAK’s work has been previously debunked and exposed by leading IP scholars like George Mason University and Antonin Scalia Law School Professor Adam Mossoff and Senator Thom Tillis (R – North Carolina) for using defective and non-transparent supporting data.

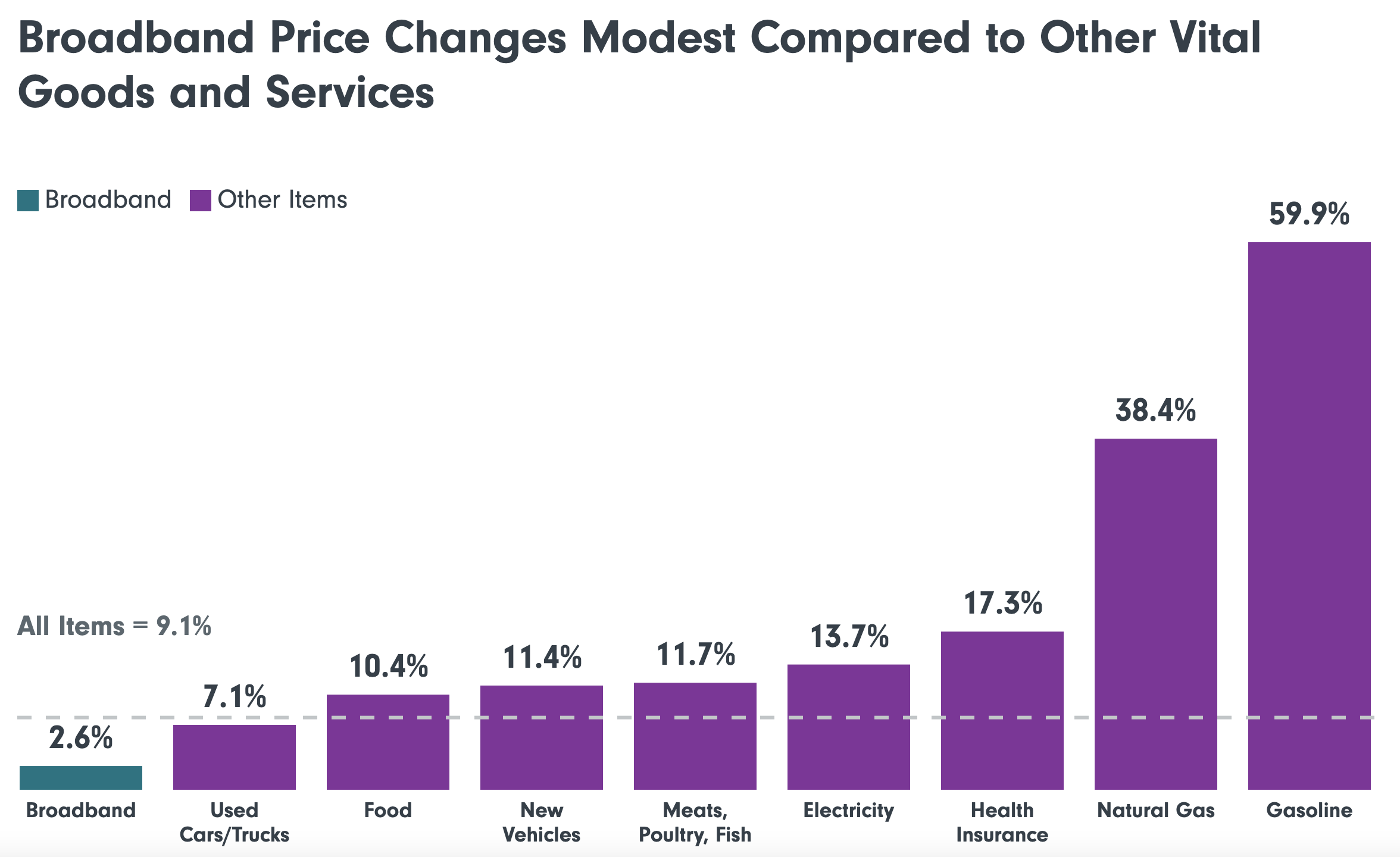

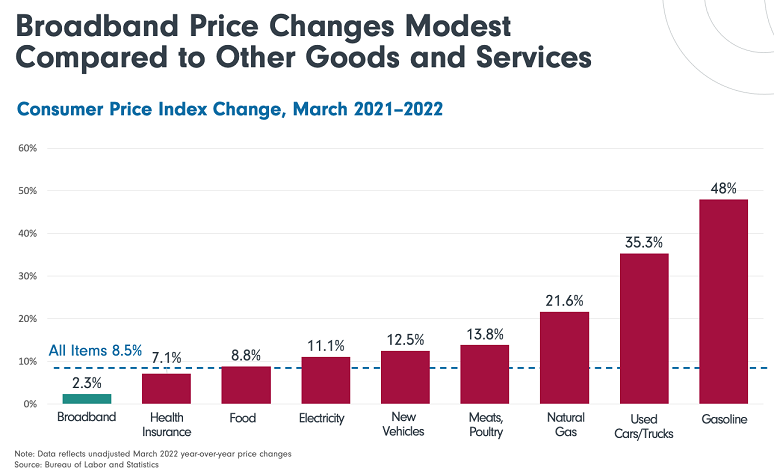

Indeed, we highlighted earlier this year how drug prices have remained far, far below overall inflation. Efforts like I-MAK’s would only end up suffocating drug innovation, not reducing prices, as we’ve also highlighted:

Of all new cancer drugs developed worldwide between 2011 and 2018, 96% were available to American consumers. Meanwhile, only 56% of those drugs became available in Canada, 50% in Japan, and just 11% in Greece, as just three examples. Patients in nations imposing drug price controls simply don’t receive access to new pharmaceuticals as quickly as Americans, if they ever receive them at all.”

Even the World Health Organization (WHO) acknowledges that overseas consumers’ lower access to pharmaceutical innovations stems from their governments’ imposition of price control regimes:

‘Every time one country demands a lower price, it leads to lower price reference used by other countries. Such price controls, combined with the threat of market lockout or intellectual property infringement, prevent drug companies from charging market rates for their products, while delaying the availability of new cures to patients living in countries implementing those policies.’”

The irrefutable reality is that U.S. patent protections explain why we produce the overwhelming share of new drugs worldwide, including the Covid vaccines. Efforts like I-MAK’s latest “study” continue a bizarre ongoing affront to property rights, the rule of law and IP. If successful, they would only mean fewer future vaccines and treatments, and must be flatly rejected.

CFIF Freedom Line Blog RSS Feed

CFIF Freedom Line Blog RSS Feed CFIF on Twitter

CFIF on Twitter CFIF on YouTube

CFIF on YouTube