Ramirez Cartoon: Trick

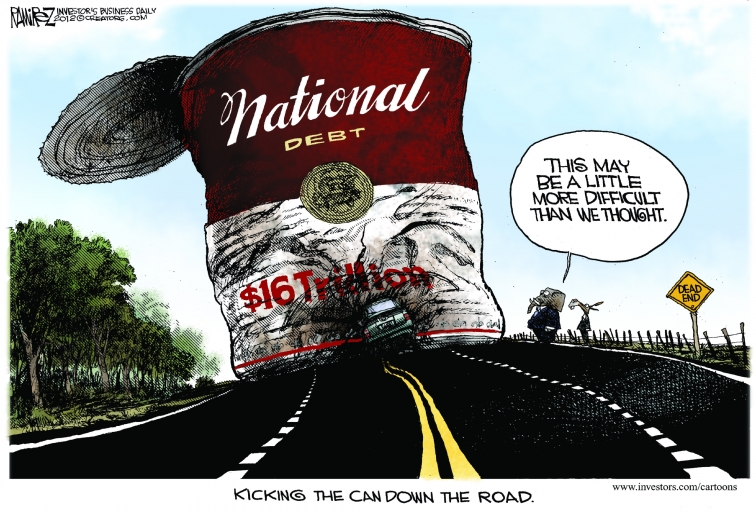

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

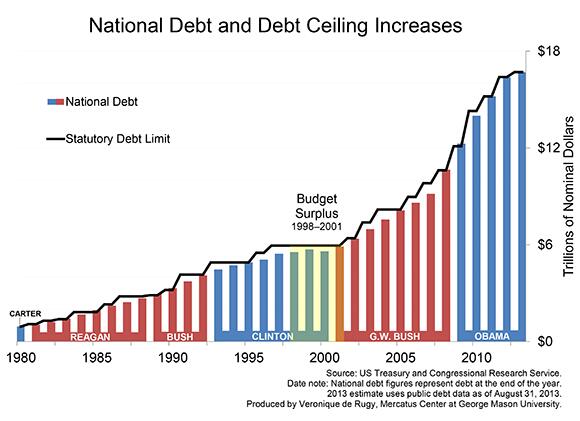

In anticipation of the debt ceiling debate/crisis/hysteria, Veronique de Rugy, a senior research fellow at the Mercatus Center at George Mason University tweeted a graph of all the times the debt ceiling has been raised since 1980.

It’s a simple but shocking illustration that tells the story of how America went from a national debt of $930 million to a national debt of $16.7 trillion in just over three decades.

The graph indicates that we clearly have two big government presidents to thank for putting Americans and the American economy in such a dire predicament: George W. Bush and Barack Obama.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

In an interview with CFIF, Elizabeth Harrington, Reporter at CNSNews.com, discusses the implications of America’s fall over the fiscal cliff and what may come from the pressure in Washington to make a deal.

In an interview with CFIF, Elizabeth Harrington, Reporter at CNSNews.com, discusses the implications of America’s fall over the fiscal cliff and what may come from the pressure in Washington to make a deal.

Listen to the interview here.

There is a certain logic to this. Why have laws, after all, that exist purely for the purpose of being broken? That being said, it’s telling that the Treasury Secretary (he of “We don’t have a plan, but we don’t like yours.”) seems more interested in eroding even the weakest checks on the national debt than in doing something to arrest — or, heaven forfend, even reverse — it’s growth.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

CFIF’s Quin Hillyer discusses America’s debt crisis on CBN News.

Over at the Wall Street Journal, James Grant, editor of Grant’s Interest Rate Observer has a perceptive review of the new book, “White House Burning: The Founding Fathers, our National Debt, and Why it Matters to You,” by former IMF Chief Economist Simon Johnson and University of Connecticut law professor James Kwak. Two passages deserve special attention.

On the banking system, Grant writes:

Here’s an idea: Let’s try capitalism for a change.

Rather than the bureaucratic monstrosity called the Dodd-Frank Act, for instance, why not hold the bankers personally accountable for the solvency of the institutions that employ them? Until 1935, bank stockholders would get a capital call if the company in which they had invested became impaired or insolvent. It was their problem, not the government’s. In the same spirit, suggests the New York investor Paul J. Isaac, let the bankers forfeit a portion of their past compensation—say, that in excess of 10 times the average manufacturing wage—if they steer their employer on the rocks. And let them surrender not just one year’s worth but rather seven year’s worth—after all, big banks don’t go broke all at once. Proceeds would be distributed to the creditors, as in days of yore. Bankers should not only take risks. They should also bear them.

And on the endless invocation of the Great Depression as the sole object lesson in how to respond to a severe economic downturn:

Messrs. Johnson and Kwak, who draw the usual conclusions from 1929-33, fail to mention the depression of 1920-21. Yet this cyclical downturn was as instructively brief as it was ugly. Peak to trough, nominal GDP plunged by 23.9%, wholesale prices by 40.8% and the CPI by 8.3%. Unemployment, as it was then inexactly measured, soared to 14% from a boomtime low of 2%. And how did the successive administrations of Woodrow Wilson and Warren G. Harding, along with the Federal Reserve, meet this national disaster? Why, they balanced the budget and raised interest rates. Yet for reasons never examined in the pages of this book, that depression promptly ended and the 1920s roared.

Grant’s theme? Responsibility, both personal and collective. That has the great virtue of being the right thing to do. It also has one even greater virtue: it works.

House Budget Committee Chairman Paul Ryan (R-WI) this morning is releasing the House GOP budget proposal. Ryan previews his budget in an op-ed in The Wall Street Journal here, and outlines the “choice of two futures” — the status quo of more debt and greater decline vs. a path to prosperity that includes less debt, lower taxes and inidividual opportunity — in the web video posted below.

Newsmax.com reports:

The gross costs of the national healthcare law rammed through Congress by President Barack Obama will reach an estimated $1.76 trillion over 10 years – nearly twice the amount originally projected.

The figure, which the Congressional Budget Office (CBO) revealed on Wednesday, is bound to cause embarrassment to the administration as it comes just as debate on ‘Obamacare’ is starting to heat up again, two weeks before the Supreme Court is set to hear arguments on whether the Affordable Care Act is unconstitutional.

Truth be told, nearly everyone already knew that the cost estimates used to sell ObamaCare to the American people were part of the White House shell game to get it passed. That much is understood by both supporters and opponents of ObamaCare. What is embarrassing is the administration’s response to the latest CBO estimate.

‘The bottom line is clear: the Affordable Care Act will reduce our deficit, control health costs and make health care more affordable,’ Jeanne Lambrew, deputy director of the White House office of Health Reform, wrote on the White House blog.

Remember, this is the same White House trying to convince you that algae is the answer to rising gas prices.

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

We’re way overdue for a Chris Christie video here on Freedom Line. Thankfully, the New Jersey governor is back in the saddle and he’s seemingly competing with Newt Gingrich to see who can blister the sitting Commander-in-Chief more thoroughly. This is a thing of beauty:

Below is one of the latest cartoons from two-time Pulitzer Prize-winner Michael Ramirez.

View more of Michael Ramirez’s cartoons on CFIF’s website here.

Begin the countdown. November 23 — one week from today — is the deadline for the bipartisan, bicameral congressional “supercommittee” to deliver its plan to cut $1.2 trillion from the federal deficit. Only problem? No one expects it to happen. From today’s Washington Post:

White House officials are quietly bracing for “supercommittee” failure, with advisers privately saying they are pessimistic that the 12-member Congressional panel will find a way to cut $1.2 trillion from the deficit as required…

Obama has stopped short of issuing a blanket veto threat if the committee tries to undo the severe cuts that would take effect in 2013 if an agreement is not reached. Obama has simply said that Congress “must not shirk its responsibilities” and, in a news conference from Hawaii, said he would not comment on the potential for a veto.

Oh, so now it’s Congress that’s shirking its responsibilities? Where was President Obama’s veto pen when more than $4.2 trillion was being added to the federal debt under his watch (more than the total federal debt from George Washington to George H.W. Bush)? And if the role of Congress is so important, why leave the task of debt reduction to a dozen congressmen out of a body of 535? And why keep members from being able to so much as amend the proposal, making the compromise that will be necessary for such a grand bargain that much harder to ascertain?

The answer, of course, is that this process has been intended all along to grease the skids for tax increases. And by threatening the welfare of the men and women of the U.S. military (failing to pass a plan would result in automatic cuts to the Pentagon’s budget that could add up to over $1 trillion), liberals are hoping they can force conservatives’ hand.

The supecommittee process deserves to end in failure. The automatic spending cuts deserve to be overridden by Congress, as does any veto that President Obama may subsequently issue. And every member of the legislative branch who helped midwife the president’s record-breaking debt deserves a one-way ticket home.